From the very beginning the event gathers key personalities (representatives of the central government, regulator) as well as solution providers and companies cooperating with the banks.

The Forum aims to gather all key market players who have influence on banking sector, allow to understand changes taking place in the sector and create opportunities for participants to strengthen contacts or establish direct business contacts with potential partners

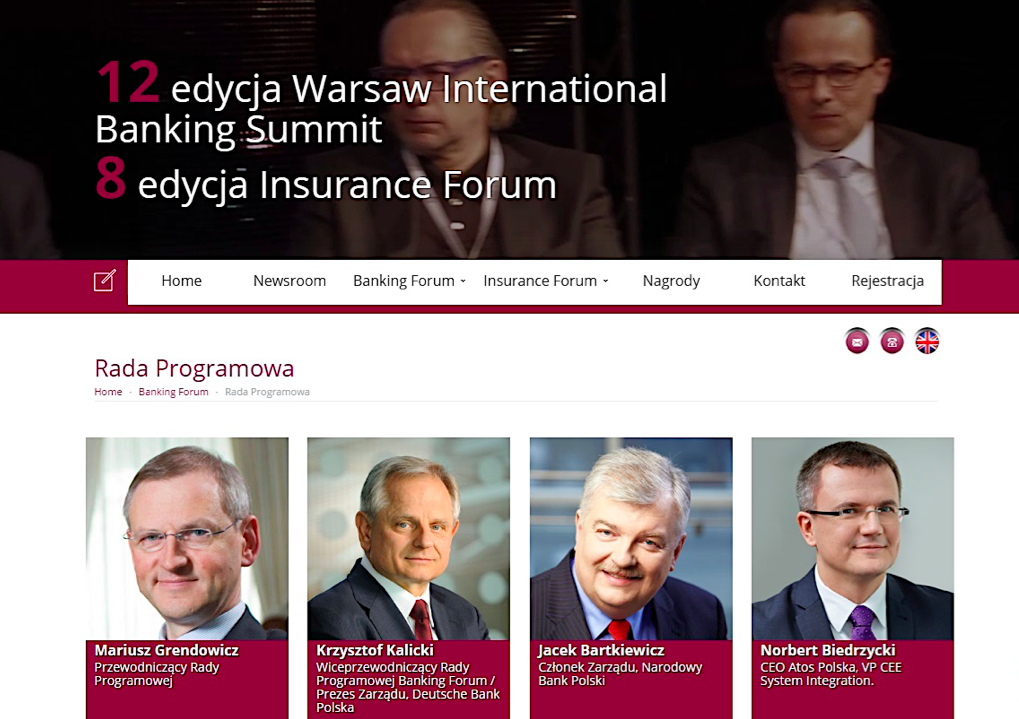

Experts and authorities from the banking market discuss topics related to current issues, global and local challenges and the most important current problems in the banking market during each edition of the event. The substantive scope of the summit is co-created by the Advisory Board under the chairmanship of Mr. Mariusz Grendowicz and Mr. Artur Olech. The Advisory Board focus bank and insurance CEOs, representatives of the administration and the largest providers of services and solutions. Recognized experts and authorities representing banking, FinTech and related services are always among speakers.

All this makes the Banking Forum a unique and prestigious platform for exchange views for the above mentioned stakeholders. The project is implemented simultaneously during autumn Meeting of Leaders of Banking and Insurance 2016, together with the VIII Insurance Forum. Therefore it allows, with full representation of finance market leaders, to cover the most important issues for all abovementioned sectors. It also ensures the presence of the most important representatives of all of the above sectors.

VIII Insurance Forum is a prestigious meeting of insurance leaders, a place of exchanging knowledge, experience and discussions about the market’s future. It is adressed not only for specialists from the insurance sector but also for all those, who are interested in the most up-to-date information from financial sphere. Seven previous editions made the Forum a fixed point in the calendar of events for key stakeholders from the industry. It provides an excellent opportunity for further debates on major issues, problems, opportunities and challenges which the insurance industry faces.

Each edition has also full attendance – the presence of the most important people from the site of the market, of the market regulator, the Financial Ombudsman. The current topics are also very important for the connected markets: banking and insurance. Participation of representative group of key representatives from the industry, science and administration enables to take a holistic look on the insurance market.

The project is implemented simultaneously during autumn Meeting of Leaders of Banking and Insurance 2016, together with the XII Warsaw International Banking Summit – Banking Forum. Therefore it allows, with full representation of finance market leaders, to cover the most important issues for all abovementioned sectors. It also ensures the presence of the most important representatives of all of the above sectors.

Speech given by President of the Management Board of Atos Poland, CEE VP System Integration Norbert Biedrzycki took place in the “Perspectives on digital transformation in the banking sector”.

TonyHor

But overall this is a future of an financial industry

TonyHor

As technology advances it is important that incumbent banks and their FinTech/challenger rivals. Most still operate a telephone helpline for customers who want to speak with someone. It has already been predicted that as the manner in which customers interact with their banks changes the high-street branches may start to close.

Norbert Biedrzycki

Some banks are more advanced. But all of them are facing the same challenge of rapidly changing industry. In few years to come current banking system and money logic will be transformed. For sure