What is cryptocurrency?

Most people know very little about cryptocurrencies. Those who’ve heard the term tend to think that cryptocurrencies are merely virtual money or a web-based transaction system. However, cryptocurrencies are mainly a pioneering Internet technology. Its use as a means of exchange is only one possible application.

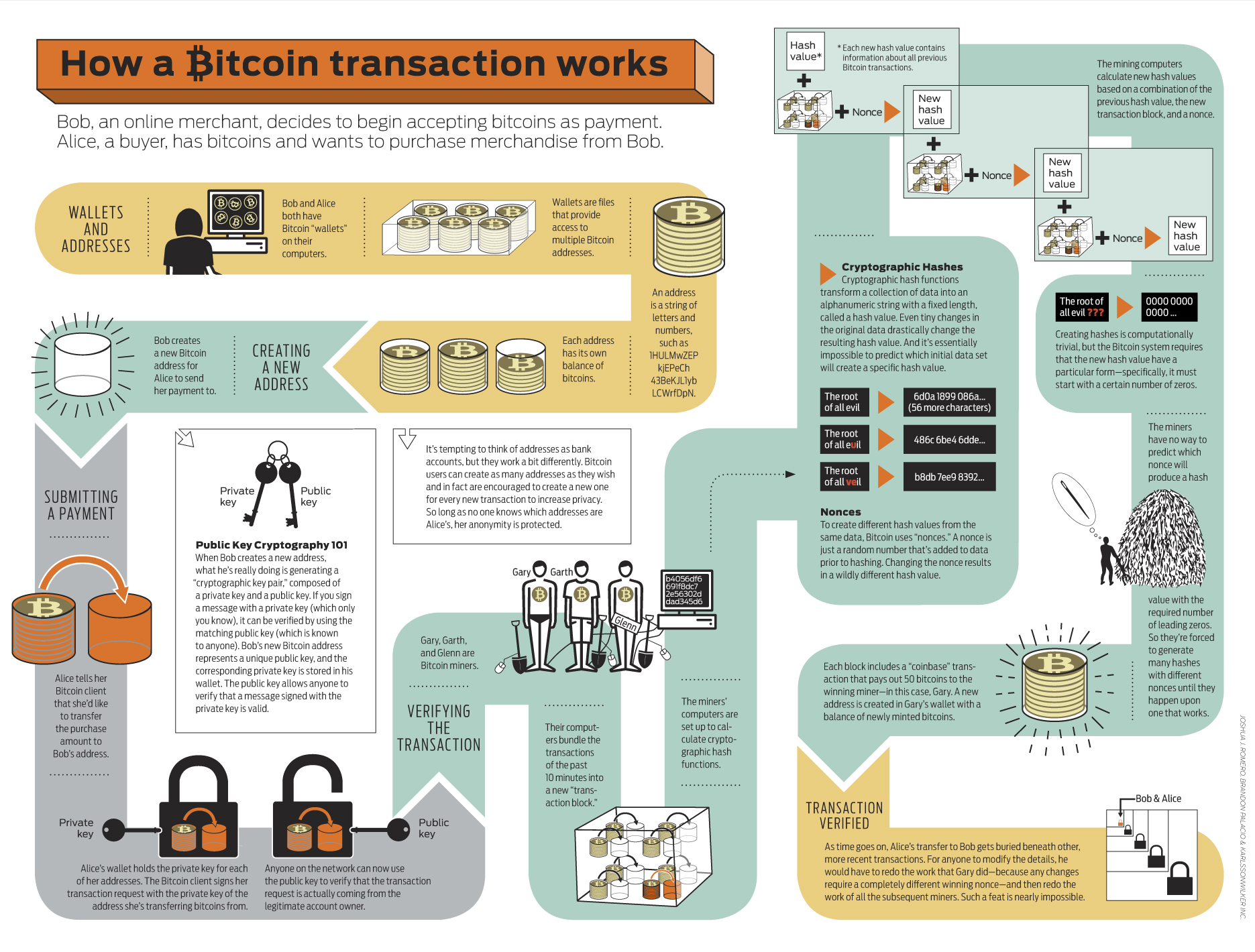

Cryptocurrency is a bookkeeping system relying on peer-to-peer networks. It is fully distributed and devoid of a central unit, organization or place that would control it. The system stores information about the ownership of arbitrary cryptocurrency units. The title to a given cryptocurrency is reflected in a wallet associated with an individual user. Complete control over the wallet is exercised by the holder of an encoded private key. Advanced mathematical and cryptographic methods are employed to prevent cryptocurrency duplication, counterfeiting or theft.

Cryptocurrencies are the first financial system invention developed outside of financial institutions without the slightest contribution on their part. It is novel, simple and fully independent of the existing financial system. What is more, it poses a threat to the status quo of that system.

Most countries around the world recognize cryptocurrencies as valid legal tender. As of to date, more than 200 cryptocurrencies are quoted on a dozen plus specialized stock exchanges. The most popular cryptocurrency is bitcoin.

What is bitcoin?

Bitcoin (abbreviated BTC) is the world’s first cryptocurrency or digital currency. Bitcoin transactions can be processed through public channels such as points of sale, currency exchange offices, banks and the Internet. The idea of bitcoin relies on blockchain. Blockchain is a fully open network accessible by means of simple applications, stock exchanges or through retail establishments. Having bitcoin data recorded in a blockchain prevents the duplication, theft or modification of even a single bitcoin. All transactions are public – their entire history is available for viewing and verification. The blockchains that serve as transaction ledgers cannot be counterfeited due to a cap placed on the number of bitcoins and protections that prevent their number from ever exceeding a predetermined ceiling. The transactions recorded in a blockchain are irreversible. The technology relies on peer-to-peer transactions and dispenses with the use of central computers and systems that manage and validate transactions. Every computer in the network may send and authorize transactions. Bitcoins may be recorded on a personal computer in a transaction ledger file or stored on an external service run by a third party. The number of bitcoins is fixed at 21 million, which limits inflation and deflation. Every bitcoin is subdivided into 100 million units called satoshi. Currently (as of November 2016), a bitcoin trades for approximately US$ 750. In the last four years, its exchange rate rose from ca. US$ 100.

Who is the father of bitcoin?

In December 2015, the US-based Wired and Gizmondo portals posted suggestions that the creator of bitcoin may be the Australian IT entrepreneur Craig Steven Wright, who himself acknowledged he had invented bitcoin under the pseudonym of Satoshi Nakamoto. The bitcoin community has refused to believe such reports. Its members are convinced that the pseudonym disguises a team of scientists, mathematicians and cryptographers. The one thing that I am confident about is that when Satoshi Nakamoto announced in October 2008 his idea of what he then called a new and entirely-peer-to-peer electronic cashless system that would eliminate third-party fiduciaries, he had no inkling he was starting a revolution that would wipe out the financial system as we know it today and transform its fundamental operating principles.

What transactions are supported by bitcoin?

Transaction ledgers can be used to store any transaction types. Thus, bitcoin may easily be made to represent a currency, property, real estate or shares. It is up to the users to decide what a given bitcoin unit stands for. Every bitcoin and satoshi is divided into individually identifiable and programmable parts. This means that users can ascribe diverse properties to each individual unit. The user can program a bitcoin/satoshi to be eurocents, company shares, kilowatt-hours of energy, election votes, loans or digital ownership titles. Therefore, the cryptocurrency is much more than just money and a means of settlement. Bitcoin can also be programmed to behave as needed. Bitcoins may self-cancel on a specified date, be exchanged or automatically return to the owner if the receiver fails to satisfy prescribed terms.

Can you buy a hamburger with bitcoin?

Bitcoins have a value because a steadily growing number of people are confident that the technology that underpins them, i.e. blockchain, also acquires value. Although with each year passing, bitcoin is becoming a fully-fledged means of exchange recognized by state governments, its value is being created by the buyers who choose to use bitcoins for their transactions. In other words, bitcoin is only worth as much as it is widespread. And although I can’t use it today to pay for a hamburger in any restaurant in Warsaw, Paris or New York City, I will most likely be able to do so in the future.

Related articles:

– Artificial Intelligence for all

– What is blockchain? All you need to know

– Blockchain has a potential to upend the key pillars of our society

– Modern technologies, old fears: will robots take our jobs?

How a bitcoin transaction works (Dr. Constantin Gurdgiev via True Economics blog)

Bitcoin and digital currency benefits (http://www.costasinc.com)

Tom Jonezz

Blockchain movement is causing a disruption on a massive scale by not only completely realigning the current global ecosystems but changing the way we live our lives. Cryptocurrencies are just one facet of the many promising use cases of the blockchain, which are being implemented globally to embrace this transparent, efficient & secure system.

Oscar2

– bitcoin is also software framework (for public blockchain network implementations)

– temper-proof depends on blockchain software used / consensus algorithms & theory of fault tolerant distributed systems

– I would not claim that blockchain is 100% secure. It is secure taking into consideration current state of technology and knowledge. For example, the quantum computers can change the rules across the blockchain space. What is more, if someone, let’s theoretically say a genius is hiding in a basement somewhere in the Northern Siberia, finds a methodology to decipher the currently used hashing functions (sha256 and sha512 being two most recognized), the blockchain as a reference data proof machine will be invalid.

Of course, these are only theoretical considerations, but still, I would not crawl into the narrative of the absolutes.

What makes me wonder is stating that blockchain is better than the traditional databases; it is not, it is different. It has the entirely different purpose of existence. Secondly, in the first sentence, the article is noting that Bitcoin is just one iteration of blockchain (cryptocurrency network), while the author is referring to the Proof-of-Work type consensus which is strictly linked to the two largest cryptocurrencies: Ethereum and Bitcoin.

Jack23

Blockchain != Bitcoin

Bitcoin == Blockchain

You can do a lot more with the Blockchain technology of immutable records (which it essentially boils down to). Unfortunately, due to poor programming there have been lost a great number of records (in this case cryptocurrency) in the past, because those records were no longer valid.

So, please nobody tell anyone that

a) This is safe to use

b) There can be no error

c) This is the “currency” of the future

Because all of the above is simply and plainly incorrect.

It is not safe, because it is not regulated (no oversight) and bad programming can/will result in you being broke in 10, if you use cryptocurrency.

Of course there can be errors. Mainly for ther reasons above (no oversight) and entire “chains” can be “lost in space” because their backtracking was diluted and/or not properly kept.

SimonMcD

Although forgery of documents is a concern/problem and DLT, along with blockchain (1st Gen DLT), can provide an immutable and secure platform to store PII data, oracles (entry points of data onto a distributed ledger) can be compromised.

If PII is controlled solely by a corrupt gov’t and does not allow for varification by the person to which the PII belongs, then this leads to potential forgery by the corrupt gov’t for nefarious purposes of the corrupt gov’t. China, Iran, NoKo, Venezuela, and many other countries come to mind that could/would manipulate a global or country-wide identity distributed ledger ID system for their own gain and control (i.e., labeling someone a terrorist who simply doesn’t agree with the views of a country). “Power corrupts, but absolute power corrupts absolutely.”

AndrewJo

The DLT is fundamentally a record of transaction history, delivering a fully transparent, accessible transactional database for governing bodies. By combining Identity & secure privacy layering mechanisms you can grant access to governing bodies without allowing regulatory snooping.

johnbuzz3

You will need to be securely authenticated with the system and have the proper access controls to the information. As a result of this problem the majority of the capital market industry is focused on development of private/permissioned DLT that will never allow an Internet based browser access to these private networks. Access will likely occur via proprietary applications or proprietarty+embedded Webkit technology. By linking credentials to individuals, individuals and assets to corporate entities we can create unique cryptographic identification tagging to tradable instruments. Wrapped within a permissioned based privacy friendly security layer it will allow association of people and assets within a hostile environment (such as a public Blockchain running on the internet). This will allow authorized parties to utilize mathematical forensics to trace the chains of ownership yet prevent regulatory snooping. Some will argue that this is a only on-ledger work effort but even ledger work requires on-ramp, off-ramp, data updates, and linked data to off ledger sources.

Adam Spikey

WAY MORE THAN A CRYPTO ONLY.

DLT use cases:

– A ledger that generally runs in a hostile environment like the public internet

– It uses cryptography to try and solve identity and ownership problems in this public environment

– It uses cryptography to try and automate business processes & reduce latency to accelerate the value of money

– Assets are on and managed on the ledger. Off ledger interactions are considered legacy, slow, and inefficient.

– Most real use cases of this technology are theoretical discussions, unimplemented, without a single live use case with enough scalability, security, or appropriate regulatory framework in place.

– Data on the DLT can be permissioned/private but all transactions on this ledger are public and all parties can see those transactions.

– DLT is the technology not the actual asset. The asset is the application utilizing the DLT (Stock trades, payments, swap trade, currencies, bonds & coupons, etc).

– Transactions are absolute, there is no reverting the transaction. Chargebacks/returns are a business process because the ledger cannot be reversed. You must initiate a transaction back to the originating party.

– Current DLT Identity & Data security mechanisms is ‘relatively unused’ cryptography built for financial services in 1990’s. These mathematics has a certain lifetime because computers and distributed calculations are getting faster & more efficient. The current cryptography is not resistive to quantum computer attacks, 5-10yr max additional lifetime, target window 2021-2026.

Norbert Biedrzycki

Great selection. Exhaustive. I would potentially add cases on SCM – goods tracking & shipping

Mac McFisher

Financial Institutions are faced with much higher regulatory, compliance costs as well as strict restrictions around capital exposure. These institutions are looking for innovative ways to reduce future regulatory and compliance costs as well as optimally manage their existing capital to generate new revenue streams.

Karel Doomm2

What does “peer-to-peer, decentralized, append-only database” mean?

You probably know what a “database” is. Some people say it is sort of like an Excel spreadsheet. In the case of Bitcoin, the spreadsheet contains information about Bitcoin Wallets, which are like bank accounts.

“Append-only” means it is a database that you can add information to it, but you can never change the information that was added to it, and you can never take information away. This is important because you don’t want people cheating by changing information in the past to make it look like you have more Bitcoin money than you actually bought.

“Decentralized” means copies of the database exists on many, many different computers, and all of these computers can append information to the database. When new information is appended, the new information is copied to all of the computers.

“Peer-to-peer” means the database is not owned by any one company or person. Anyone can create a copy of the database and use the network. Everyone who has a copy of the database and connects to the network is an owner of the database.

Basically, blockchains are a technology, and like all other technologies, it can be used to solve various problems. Bitcoin is just one place where a blockchain is used.

Also, in my opinion, Bitcoin and crypto-currency is a waste of time and electricity, and I don’t think it will be very valuable for very long, it will probably suffer an economic crash in the near future. However the blockchain technology for Bitcoin is very interesting.

Oscar2

Blockchain is immutable. Reality: Blockchain uses immutable data structures. You might want to clarify how those 2 opposing statements (back to back) are both true.

Jacek B2

New industries have emerged, referred to as FinTech (for finance and technology) and Insurance Tech (or InsurTech). The traditional financial sector has been seeing a lot of developments.

AndrewJo

Since the 2008 financial crisis, twenty of the world’s largest banks including JPMorgan, Citibank and HSBC have paid over US$235 billion in fines

CabbH

Banks are subject to regulation.

They need licences to operate.

I don’t see banks ever attaining full freedom.

johnbuzz3

The price of bitcoin inched upward over the course of trading today, passing $1,000 for the first time on CoinDesk Bitcoin Price Index since early January 2014.

http://www.coindesk.com/bitcoin-price-1000-january-1-2017/

Norbert Biedrzycki

… and now it’s 950 USD

Mac McFisher

Think about DAO. Think of it as a hub that disperses ETH to other startups and projects. Backers of The DAO receive voting rights by means of a digital token, which can be used to help determine the future direction of the organization and which projects will actually get funded following a voting period.

The DAO’s objective is to support sharing economy projects delivered by “contractors” by allocating ETH raised during its creation phase. The project has currently raised $51.1m worth of ETH by selling tokens or voting rights in exchange for ETH or other returns.

Norbert Biedrzycki

Classifications of Notable Cryptos

JohnE3

It can not be concealed that blockchains and cryptocurrencies are new and conservatives tend to celebrate such inventions with a wide arc, but there are many wealthy people who are very interested in this technology, because even if it enables being anonymous. Even Bill Gates himself admitted to having BTC during one of the interviews. And the Winklevoss brothers and their investments in the crypto? For 10-20 years, cryptocurrencies may forget and maybe conquer the world like email or the internet.

Norbert Biedrzycki

We will see 🙂

Adam Spark Two

Check this McKinsey article: https://mck.co/2GZh8iP

TomHarber

BTC represents the emergence of a new asset class. It has consistently been the lowest correlated asset to other traditional asset classes. I believe bitcoin is a great investment to diversify your portfolio. Overall, while BTC presents a case as a good diversifier, it isn’t free from risks, and investors check different options before taking on exposure. Investors can consider a small addition of 1% to 2% of their portfolio to BTC with a medium- to long-term view. This is what I would recommend

DDonovan

BTC is cool, but the underlying technology behind it – the blockchain – is way cooler. Gives lot’s of opportunities. It is also a very cost-effective method to keep your data. Many companies including major financial institutions have expressed interest in this technology.

TonyHor

In my opinion technology invented to disrupt banking and money management is embraced by the financial services sector (what a surprise !!!) the financial regulators

Norbert Biedrzycki

Very correct. All of market players are surprised that blockchain revolution is treated by all parties as a new way of growth, real disruptive enabler. Interesting to watch how this is going to transform financial sector during next few years

DDonovan

Blockchain can help to hold the honest voting in countries. It’s not the people who vote that count, it’s the people who count the votes. Thanks to blockchain technology it is not possible to erase the vote or change it. What’s more, it can influence the healthcare industry and resolve the energy issues.

TonyHor

Fintech is all why incumbents are joining the R3 consortium. It’s a direct treat to status quo. Disruption from new players it’s rather threat and risk. It’s hype cycle that we haven’t seen in a very long time. This is gonna trasform IT industry as well.

johnbuzz3

Good article of bitcoin functioning especially for those with an IT background. Bitcoin’s strength lies in its mathematical design. Its open nature eliminates the need for trust. In bitcoin, nobody can just decide to increase the amount, including the creator of bitcoin. Currently is 21 mln BTC. Bitcoin is more like gold than cash.

Norbert Biedrzycki

You’re correct that nobody owns the Bitcoin, even the inventor. Bitcoin is collectivelly controlled by all users. Developers are working on apps but still they cannot force a change in the protocol itself. Software should comply with the same rules accross all apps. All users and developers have a strong incentive to act according to the consensus since this is highly standarized among them.

TomCat

Usage is very simple. Once you have installed a Bitcoin wallet on your computer or mobile phone, it will generate your first Bitcoin address and you can create more whenever you need one. You can disclose your addresses to your friends so that they can pay you or vice versa. In fact, this is pretty similar to how email works, on usual wys.