Tulip mania. First economic bubble

The winter of 1637 saw a massive crash of the tulip bulb market. With their prices long growing and the hope was that the trend would continue indefinitely. But then they reached a point where no one could afford them any more. “This entire delusional world came crumbling down” – wrote Zbigniew Herbert in his essay Tulipanów gorzki smak (The bitter taste of tulips) – “If anyone traced back and plotted the tulip mania curve, it would bear a surprising resemblance to that of the fever of a patient suffering from a severe infectious disease. The line climbs rapidly, plateaus for a while only to plunge down dramatically”. First economic bubble.

My reference to Herbert and tulips coincides with repeated warnings of another burst of a dot-com bubble. We have been hearing such gloomy prophesies since at least 2007. Even then, Facebook’s worth was estimated at US$ 15 billion, nearly as much as Ford’s. Although many argued that its stocks were bound to crash, FB has now exceeded the US$ 300 billion mark and the spiteful bubble is not bursting.

It is indeed spiteful as the burst is what many would like to see. This includes the press, left at the mercy of Facebook and Google; booksellers waging a war with Amazon; cabbies fighting Uber and hoteliers losing their market to Airbnb. This picture differs fundamentally from that seen 16 years ago when the crisis first broke out. At that time, everyone wished for the technological boom to last forever.

Internet bubble 1.0

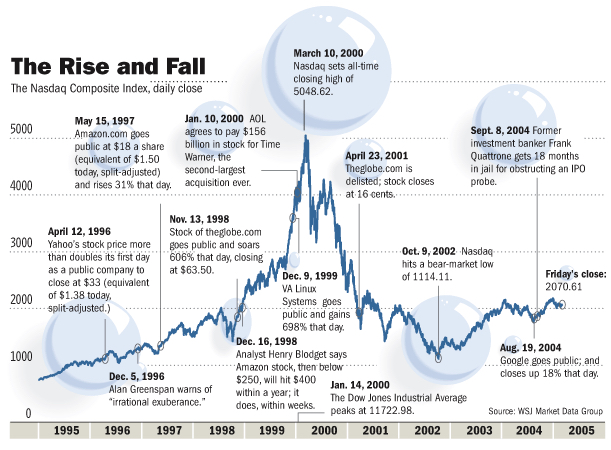

The memories of the spring of 2000 are still alive. New dot-com launches were a daily occurrence at the New York stock exchange. The prices skyrocketed. On March 10, NASDAQ closed with a record of 5 048 points only to drop by 77% in the following 30 months. It is a repetition of this scenario that the market fears today.

Are we at risk of seeing a replay of 2000?

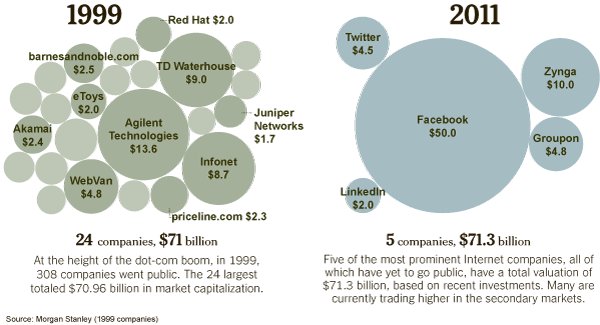

First of all, the market has never fully recovered from that collapse. It may seem to have gone through the roof in 2000 but, factor in inflation, and you will see that its current levels are a far cry from those of 16 years ago. Yet, there is one thing that worst-case-scenario proponents are failing to see – we are living in a whole different world. The Internet has 10 times as many users today as 16 years ago and plays a much greater role in our lives. In 1999, the revenues of Internet giants were largely hypothetical. Today, Facebook and Google have shown one can actually make money on the web. And a lot of it too. One might venture to say that the two corporations have joined the “mainstream” economy.

The same is not the case for the whole market. We know next to nothing, if anything at all, about many young players. The majority don’t publish their financial results or do so very selectively. Facebook, Google and Microsoft are now listed and obliged to disclose their financials but many refuse to follow suit. Hardly anything is known about their incomes and profits. Without such information, it is hard to tell where we stand.

Even if we knew their results, we would still face a problem. The companies’ valuations are based on the future revenues that investors expect. These can easily be assessed for Apple or Google on the basis of historic performance. In the case of the startups that are still to make their first buck, it is difficult to make any rational assessment whatsoever. Young tech companies of this sort come in thousands. More than 100 of them, including Uber, Airbnb, Dropbox, Pinterest, Spotify and many others you have never even heard of, have been priced above US$ 1 billion.

Rising valuation of internet companies

Meanwhile, stock buyers remain unfazed. Uber has sold a 2% of its shares for US$ 1 billion. This places its overall worth (at least hypothetically) at US$ 50 billion. It is likely that even stock buyers themselves do not believe in this astronomical figure. What they do count on is that the company will be worth that much in the future. And not without a good reason.

Another example: Snapchat is currently estimated at approximately US$ 16 billion despite never having generated a profit. Back in 2014, it hardly had any income to speak of. But it has another strength – every day, 100 million people across the world use its services. The experience of Facebook, for instance, shows that such a user base is certain to attract advertisers. And the profit will follow.

Airbnb – According to critics, the company is severely overvalued as, without any hotels of its own, it is worth more than Marriott, whose chain owns 4,000 facilities. However, Airbnb relies on a whole different business model than that of traditional hotel chains. And even more importantly, its growth prospects are a whole lot better. Marriott needed over 88 years to built up its network of 700,000 rooms. Within mere 7 years, Airbnb’s portfolio has come to comprise more than 2 million offers. And, by all indications, it is set to grow faster than traditional hotel chains.

Does this mean there won’t be a crash?

No one can tell but there are many companies that are fairly cheap relative to their value. Meanwhile, others are considerably overpriced. The startups looking to attract financing and good engineers must in fact drive their valuations excessively high. They don’t have the revenues that would allow them to be quoted on the stock exchange and get their funding there. They cannot get sold as no one is willing to pay the price they have quoted. The only option they are left with is to reach out to investors for further shots in the arm. When they run out of money, we will find out if and how Silicon Valley’s golden children will be able to stand on their own two feet.

I have no doubt that the collapse will come eventually. As Herbert put it: “One cannot place a big full stop after the date of 1637 and consider the matter over and done with for good (…) Some day, in one form or another, disaster will strike again”. The only question is: what damage will it do then?

Related articles:

– Only God can count that fast – the world of quantum computing

– Machine Learning. Computers coming of age

– The invisible web that surrounds us, i.e. the Internet of Things

– Artificial Intelligence as a foundation for key technologies

– Artificial Intelligence for all

– Top 5 technology events of 2016

– What are the bitcoins? All you need to know

– The brain – the device that becomes obsolete

– Sagrada Familia and the Internet of Things

Internet bubble 2000

Valuation of internet companies 1999 vs 2011

CabbH

In light of recent stock plunges, some of which are affecting Internet giants, it’s not surprising that some market forecasters are predicting we may be headed for another busted Internet bubble. Reasons for this include a decrease in private startup funding rounds and more startups finding it necessary to raise money overseas, because big investors no longer seem to trust Internet valuations.

John McLean

Bubble is gonna blow. Max in 2018. Examples: Uber – loss making, Salesforce.com – never profitable, AirBnB – disruptivelly unprofitable ☺️

Don Fisher

Wall Street just suffered its worst quarter in last 5 years, and many tech companies’ stocks have failed significantly. IMHO next generation of hyped tech startups, while commanding jaw-dropping private valuations, has been slow to go public. Layoffs have begun at heavily valued startups. In winter 2000, lot’s of high-flying tech companies planned opulent holiday parties. By the time nearly 2 years later, the Nasdaq composite index was more than 75% of its peak value. Many investors and tech workers had lost everything. Are wee seeing the same? Quite probable

Norbert Biedrzycki

Valuation of interenet comapnies is skyrocking. This is higly unjustified bassed on business results comparing to “old economy” standards. Unfortunatelly we might face 2nd bubble soon. But this time only bigger

TomCat

I think the current bubble looks almost like the .com bubble in the year 2000. But no one thinks that their in a investment bubble untill it ends. That was surelly the case with the previous .com bubble. I remember talking to an older woman during the housing boom years ago. She recently sold here home and bought another home and was ranting about how the price of real estate had increased over the years. When I suggested that the market was overheating and house prices were high alredy she responded that they her house is worth a lot more now than it was worth just a few years ago. Funny and scarry

DDonovan

Great coverage! Wait a few years and you will understand it all and you might think of whatsapp selling for billions to FB. “Dotcom” aol buys icq

CaffD

The recent purchase of WhatsApp by Facebook for a reported price equaling $345 million per employee prompts me to think that bubble is coming. It also brings back vivid memories, seen from the inside. At the time I was with SAP and seeing stock price droping down was a nightmare.

Norbert Biedrzycki

At least 145 private companies have won valuations exceeding $1 billion. VC/ PE executives are left with a difficult choice: cut costs drastically to become self-sustaining, or seek additional capital on ever-more-onerous terms. Good article: http://on.wsj.com/1rboDeG