What is blockchain?

Blockchain is a technology used to store and transfer information on Internet transactions arranged into successive data blocks. A single block contains data on a specific transaction. Once a block fills up with data, another one is created, followed by another and yet another, until an entire chain is formed. A new block appears in a blockchain every 10 minutes on average. A block may be used to send information on multiple transactions that concern commercial deals, ownership titles, company shares, the sale and purchase of electrical energy and the purchase or sale of currencies, including cryptocurrencies (i.e. electronic currencies).

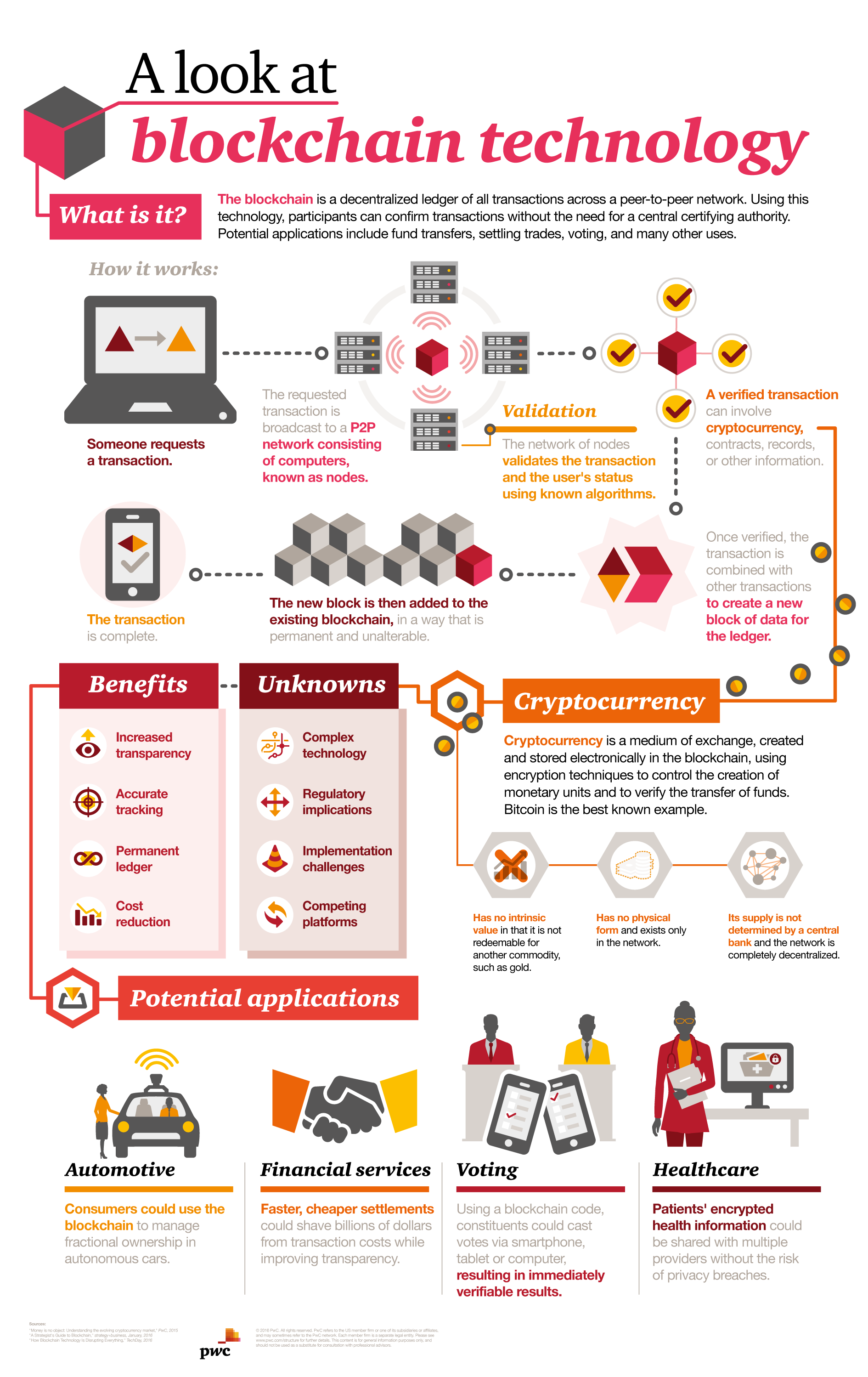

How does blockchain work?

In essence, blockchain helps maintain a shared collective digital transaction ledger whose identical copies are distributed across the web. The technology relies on a peer-to-peer network operated without central computers or systems that manage and validate transactions. Every computer in the network may take part in transaction transfers and validation. In the case of blockchain, computers work with blocks kept in transaction ledgers. The ledger is accessible to anyone and fully secured against unauthorized access by means of sophisticated encryption tools. User access is limited to their own transactions. This recording method makes the transactions public and accessible to the extent allowed by a given user’s authorization rights. The entire transaction history from the very inception of the blockchain to the present, can be viewed and verified.

What is blockchain used for?

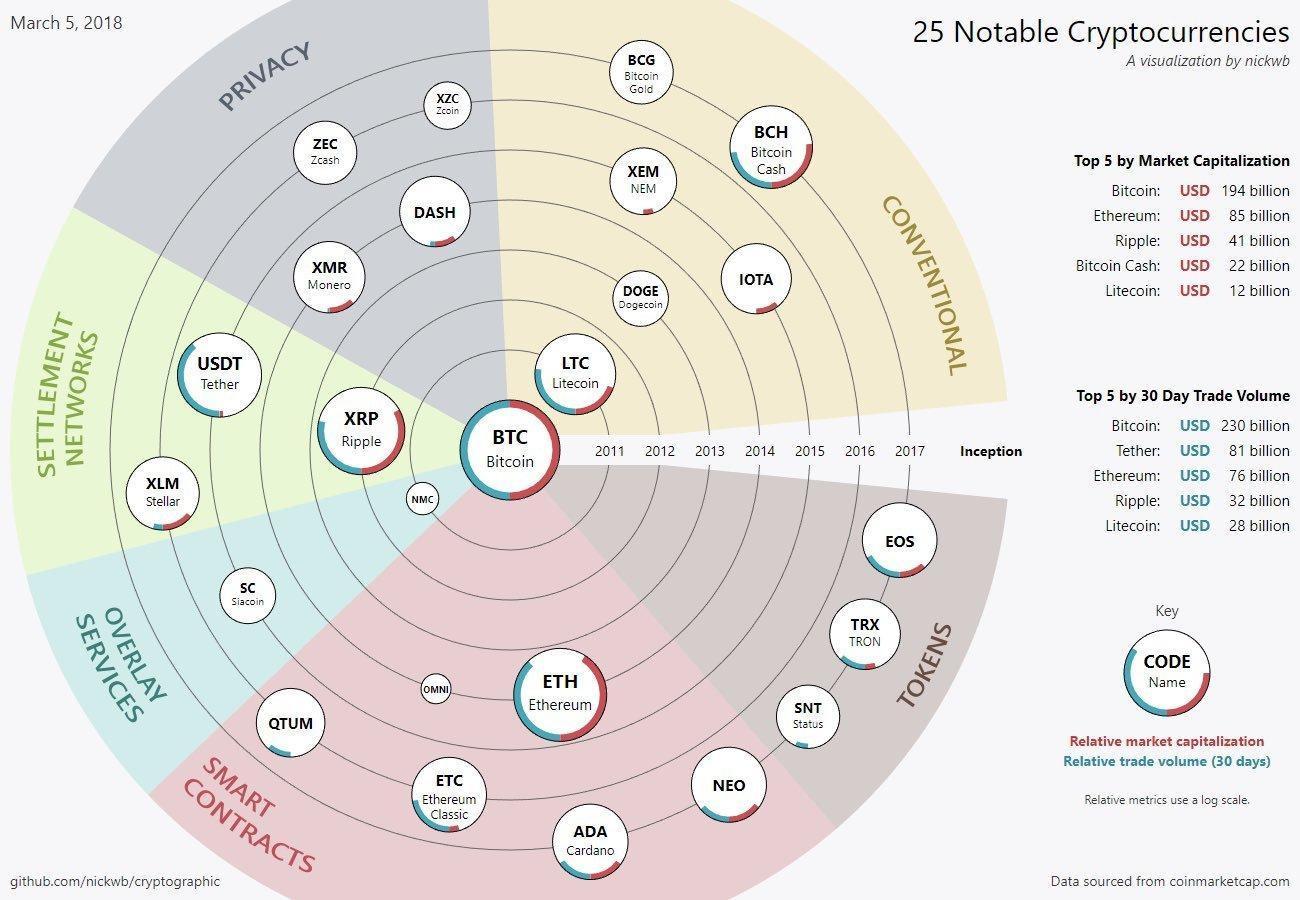

As of to date, blockchain makes possible a range of diverse transactions (commerce, currencies, shares, electricity). Work is under way to use blockchain as a banking ledger, a document authentication system, a digital signature in a state administration and for document notarization. All such transactions may be performed outside of the age-old system, without the involvement of fiduciaries, directly between transaction parties. The data blocks of blockchain networks can be used to store any types of transactions. One of the possible applications are cryptocurrencies such as bitcoin. While the future of bitcoin itself is fairly uncertain, many industries, including finance, energy and trade, have recognized the potential of both its technology and transaction platform.

Is the technology secure?

A blockchain serving as a transaction ledger cannot be counterfeited by means of today’s technology and processing power. To crack a blockchain network, one needs the computational power of an estimated half of the Internet. However, with the advent of quantum computers, new cryptographic protections will become necessary. The transactions encoded in a blockchain are irreversible. An attempt to modify one block changes the entire chain down the line. Should someone try to cheat, alter an existing transaction or enter an unauthorized deal, blockchain nodes will, in the validation and reconciliation process, discover the single copy of the ledger whose transaction is inconsistent with the transaction record of the network and refuse to add it to the blockchain. Data, transactions and their sequences are secured against any attempts at counterfeiting or tampering. The philosophy behind blockchain, advanced mathematical methods and cryptographic protections make the data contained in transaction ledgers trustworthy.

Who will be the first to use blockchain commercially?

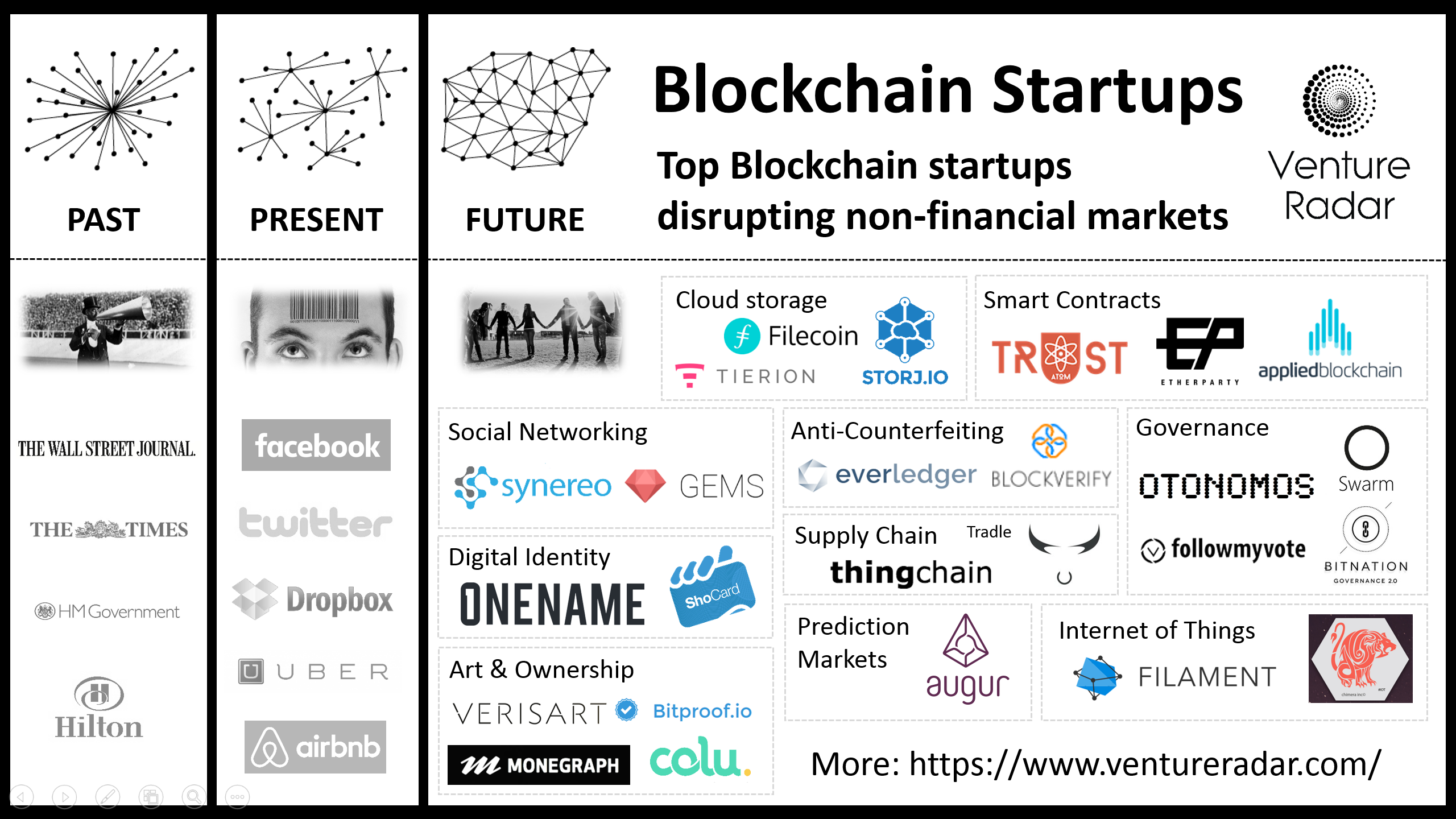

The first sector to appreciate the potential of blockchain but also to recognize the risk that it poses to its status quo was finance. Since 2014, start-ups dedicated to developing blockchain-based cryptocurrency technologies have been cropping up in great numbers. New industries have emerged, referred to as FinTech (for finance and technology) and Insurance Tech (or InsurTech). The traditional financial sector has been seeing a lot of developments. In 2015, a consortium was set up comprised of banks and FinTech companies with a mission to advance blockchain. As of September 2016, its members included Citi, Bank of America, Morgan Stanley, Societe Generale, Deutche Bank, HSBC, Barclays, Credit Suisse, Goldman Sachs, JP Morgan and ING. In July 2016, Citi announced the creation of its own cryptocurrency called Citicoin. In October, the FinTech start-up Chain.com was given US$ 30 million in financing (from Nasdaq, Visa, CapitalOne, Orange and Citigroup) to develop a solution that would make it possible to send various valuable assets (loyalty points, shares, coupons and various financial instruments) on the web.

The next to take notice of the blockchain’s potential was the energy sector. Blockchain is perfectly suited for settling energy sales transactions concluded between such small energy producers as households and their customers, energy users, including dispersed buyers, among them electric cars. Notable players in the field are Elon Mask and SolarCity, which invest not only in electricity production and storage but also in the distribution and settlement of transactions with the use of blockchain. These are only some of the most obvious applications.

Related articles:

– Machine Learning. Computers coming of age

– The invisible web that surrounds us, i.e. the Internet of Things

– Artificial Intelligence as a foundation for key technologies

– End of the world we know, welcome to the digital reality

– What are the bitcoins? All you need to know

– Blockchain has a potential to upend the key pillars of our society

– Work of the future – reinventing the work

– On TESLA and the human right to make mistakes

– Sagrada Familia and the Internet of Things

– Blockchain – the ultimate financial crash

How blockchain technology works – source: PWC

Banks and financial services exploring blockchain – Diana Biggs

Blockchain startups

Oscar2

I would not claim that blockchain is 100% secure. It is secure taking into consideration current state of technology and knowledge. For example, the quantum computers can change the rules across the blockchain space. What is more, if someone, let’s theoretically say a genius is hiding in a basement somewhere in the Northern Siberia, finds a methodology to decipher the currently used hashing functions (sha256 and sha512 being two most recognized), the blockchain as a reference data proof machine will be invalid. Of course, these are only theoretical considerations, but still, I would not crawl into the narrative of the absolutes. What makes me wonder is stating that blockchain is better than the traditional databases; it is not, it is different. It has the entirely different purpose of existence. Secondly, in the first sentence, the article is noting that Bitcoin is just one iteration of blockchain (cryptocurrency network), while the author is referring to the Proof-of-Work type consensus which is strictly linked to the two largest cryptocurrencies: Ethereum and Bitcoin.

AndrewJo

The DLT is fundamentally a record of transaction history, delivering a fully transparent, accessible transactional database for governing bodies. By combining Identity & secure privacy layering mechanisms you can grant access to governing bodies without allowing regulatory snooping.

Adam Spikey

DLT use cases:

– A ledger that generally runs in a hostile environment like the public internet

– It uses cryptography to try and solve identity and ownership problems in this public environment

– It uses cryptography to try and automate business processes & reduce latency to accelerate the value of money

– Assets are on and managed on the ledger. Off ledger interactions are considered legacy, slow, and inefficient.

– Most real use cases of this technology are theoretical discussions, unimplemented, without a single live use case with enough scalability, security, or appropriate regulatory framework in place.

– Data on the DLT can be permissioned/private but all transactions on this ledger are public and all parties can see those transactions.

– DLT is the technology not the actual asset. The asset is the application utilizing the DLT (Stock trades, payments, swap trade, currencies, bonds & coupons, etc).

– Transactions are absolute, there is no reverting the transaction. Chargebacks/returns are a business process because the ledger cannot be reversed. You must initiate a transaction back to the originating party.

– Current DLT Identity & Data security mechanisms is ‘relatively unused’ cryptography built for financial services in 1990’s. These mathematics has a certain lifetime because computers and distributed calculations are getting faster & more efficient. The current cryptography is not resistive to quantum computer attacks, 5-10yr max additional lifetime, target window 2021-2026.

Norbert Biedrzycki

Thank you for sharing. Great selection. Exhaustive. I would potentially add cases on SCM – goods tracking & shipping

TomK

Financial Services is expecting Smart Contracts to be a container for the execution of financial business transactions. These containers need stronger security and identity to assure all parties are known, trusted. Existing business models can be coded into Smart Contracts to accelerate the value of money.

johnbuzz3

This can only occur if the transactions themselves are tied back to real world identities yet layered with security mechanisms that protect the privacy yet allow role based regulatory insight into the transactions themselves

johnbuzz3

It will be nearly possible for bad actors to continue to create the same chaos thats occurring today. You will need to be securely authenticated with the system and have the proper access controls to the information. As a result of this problem the majority of the capital market industry is focused on development of private/permissioned DLT that will never allow an Internet based browser access to these private networks. Access will likely occur via proprietary applications or proprietarty+embedded Webkit technology. By linking credentials to individuals, individuals and assets to corporate entities we can create unique cryptographic identification tagging to tradable instruments. Wrapped within a permissioned based privacy friendly security layer it will allow association of people and assets within a hostile environment.

Oscar2

– bitcoin is also software framework (for public blockchain network implementations)

– temper-proof depends on blockchain software used / consensus algorithms & theory of fault tolerant distributed systems

CabbH

The banks and the state are in alliance. The terms are that both state and bank assets will be propped up by state power, one way or another, so both bankers and politicians can receive “free” power and wealth by issuing those assets (politicians by issuing public debt.) The state provides power, and the banks provide financial innovation. The central bank holds the alliance together by having power to make sure neither side endangers the alliance by issuing too many assets.

The victims of this alliance are everyone else.

TomHarber

The Bitcoin cryptocurrency has been making headlines already for several years. But in recent months the focus has widened to the broader potential of the blockchain technologyin other industries as well. Now the focus has shifted again, to the implications blockchain brings for financial assets. Check this one: http://bravenewcoin.com/assets/Industry-Reports-2016/Morgan-Stanley-blockchain-report-April-2016.pdf

Norbert Biedrzycki

Very interesting report. I like this part mostly and this is still unknown space:

… At the heart of our interest is this: will distributed ledger help or hinder financial institutions?

The bullish case is that sharing and decluttering of infrastructure could radically reduce costs and provide much needed boost to RoEs. Let’s be clear, for many banks, especially investment banks in 2016, a radical reduction and simplification in processing costs would be a blessing. We showed in our recent Blue Paper with Oliver Wyman that banks will need not just to prune but also to change their model to sweeten their RoEs 2-3% to hit hurdle rates. According to Santander, more efficient digital ledgers could cut costs in the banking industry by up to $20 billion a year.

The bearish case is that dramatic reduction in margins at the same time as higher IT spend is destabilising and disruptive. It also risks profit pools leaking to other players.

Mac McFisher

‘The DAO’, as it’s called, takes its name from the description for a new type of entity: a distributed autonomous organization. Intended to act as a vehicle for supporting Ethereum-related projects, The DAO has garnered over $50m worth of ethers (ETH) – the digital token of the Ethereum network – from investors.

Jacek B2

Ageing IT platforms tend to hamper company transitions. They are the most common reason why business scaling fails or grinds to a halt after a sudden spike in sales.

Don Fisher

If you have one of the few very large blockchains, then it’s not easy for someone to control 51% of the processing power. But it is possible and it has been done.

My point was that for any small blockchain (other than, say Bitcoin or etherium), there is no security at all, because you can just rent 10,000 machines from AWS or GCP for a day and take over any small blockchain.

DDonovan

Blockchain has enormous potential also in many other segments, not only finances. Smart Contracts, which are based on the blockchain ethereum protocol, can help in the disgustingly complex system of settlements between the streaming platform and the artist. There are many blochcains – practically every cryptocurrency is a different blockchain. There are many applications for Fintech, banking, supply chain. This is definitely a huge future. And all in all it’s simple enough that a distributed and secure database.

Oscar2

Blockchain is immutable. Reality: Blockchain uses immutable data structures. You might want to clarify how those 2 opposing statements (back to back) are both true.

Please do read our response to this great article!

https://gospel.tech/mckinsey-gospel-blockchain-beyond-the-hype/

Jack23

It is not safe, because it is not regulated (no oversight) and bad programming can/will result in you being broke in 10, if you use cryptocurrency.

Of course there can be errors. Mainly for ther reasons above (no oversight) and entire “chains” can be “lost in space” because their backtracking was diluted and/or not properly kept.

Use with caution. You have been warned!

TonyHor

Not only virtual money. IBM is looking to transform public records’ management by introducing blockchain technology in the fields of health, education and real estate. Interesting. Blockchain could be used for public admin purposes. https://www.cryptocoinsnews.com/ibm-looks-put-kenyas-public-records-blockchain/

Norbert Biedrzycki

Very interesting example in public sector. Highly recommended to read

Adam T

Good read. Thanks for sharing this one

Norbert Biedrzycki

Classifications of Notable Cryptos

Karel Doomm2

What does “peer-to-peer, decentralized, append-only database” mean?

You probably know what a “database” is. Some people say it is sort of like an Excel spreadsheet. In the case of Bitcoin, the spreadsheet contains information about Bitcoin Wallets, which are like bank accounts.

“Append-only” means it is a database that you can add information to it, but you can never change the information that was added to it, and you can never take information away. This is important because you don’t want people cheating by changing information in the past to make it look like you have more Bitcoin money than you actually bought.

“Decentralized” means copies of the database exists on many, many different computers, and all of these computers can append information to the database. When new information is appended, the new information is copied to all of the computers.

“Peer-to-peer” means the database is not owned by any one company or person. Anyone can create a copy of the database and use the network. Everyone who has a copy of the database and connects to the network is an owner of the database.

Basically, blockchains are a technology, and like all other technologies, it can be used to solve various problems. Bitcoin is just one place where a blockchain is used.

Also, in my opinion, Bitcoin and crypto-currency is a waste of time and electricity, and I don’t think it will be very valuable for very long, it will probably suffer an economic crash in the near future. However the blockchain technology for Bitcoin is very interesting.

Jack23

Please nobody tell anyone that

a) This is safe to use

b) There can be no error

c) This is the “currency” of the future

Because all of the above is simply and plainly incorrect.

It is not safe, because it is not regulated (no oversight) and bad programming can/will result in you being broke in 10, if you use cryptocurrency.

Of course there can be errors. Mainly for ther reasons above (no oversight) and entire “chains” can be “lost in space” because their backtracking was diluted and/or not properly kept.

Bitcoin aka Cryptocurrecy is the first use of the Blockchain technology (of immutable records). This was mainly (my personal view) to get rich quick on the inventor’s side.. The Blockchain technology is a great way to keep records i.e. for who owns which real estate and to whom was it sold, but it is far from “complete” or “error free”.

Jacek B2

Great link. Thanks for sharing

johnbuzz3

Corporations wasting lots of money on what they thought would be a hostile takeover of open source software on blockchain technology. They don’t understand that successful deployment of blockchain requires a partnership approach, cooperation, not monopoly. This technology will change the role of current fin system.

Norbert Biedrzycki

And this is very correct that blockchain collaboration requires partership, win-win approach. We need to learn a lot

John McLean

In 2017, expect the emergence of blockchain technology applications, especially smart contracts which are contracts written in code in a ledger system. These are typically more secure and irreversible than traditional contracts, but creates efficiencies in referencing and executing these contracts. http://bit.ly/2qVbril

AndrewJo

An individual, or an entity’s identity can be stored in an Identity Provider and utilized on the blockchain, ensuring secure and rapid ID authentication without the warehousing of sensitive data at third-party repositories. This will allow KYC/AML information to be directly propagated via DLT yet still protect the privacy of the individual

TomCat

One issue with using blockchains in place of databases is that there is an inherent lack of privacy. You gave the example of registering and selling a car. With a centralized database, only the government or whomever owns it knows that I sold it. But with a blockchain, anybody can find that out. I guess the data could be anonymized, but there has to be some identifying data, otherwise the verification process isn’t very useful. I know that this is encypted but sill algoythm could be broken opening my ballance sheet to everybody.

johnbuzz3

Bitcoin’s network is inherently very secure. So the only thing that matters is how you are holding your Bitcoin. We know that it’s possible for banks to collapse, and while unlikely, Bitcoin is only held by you and only you are responsible for it, so while the third parties associated with banks and with fiat can never be 100% reliable, Bitcoin allows freedom on the Internet which is what makes it so secure. So basically, if you actually own your private keys and don’t rely on any third party (e.g. run a full node), you’ll be far more secure than any fiat holder could make you. But it gives you a lot of responsibility which you have to take seriously, and a lot of Bitcoin has been lost before.