My article in Data Driven Investor published 11th of January 2019.

If blockchain becomes universal, we will be able to declare our taxes more conveniently, buy houses faster and more securely, exercise better control over the decisions of public administrations and store and make available our data in public registers. Public administrations and even state governments will gain a tool to better manage not only the economy, but also public interest. In keeping with its obligation to use funds efficiently, the public sector could generate huge savings as, by definition, blockchain cuts out costly intermediaries from the transaction process. Hence, benefits could be gained by both the average citizen and society at large. What is crucial in the context of public administration is that blockchain can be highly trustworthy. Any two parties who have never seen, known or even trusted each other can conclude a contract confident that no fraud is possible.

We are victims of documents

What are the expectations of the citizens who approach a public servant? The answer is simple. They want clear legislation, a service delivered in a friendly and competent way, efficient procedures, the confidence that their personal data will not be abused, and low transaction costs.

Is all this delivered to regular citizens? Unfortunately, the question is purely rhetorical. The reality is very different and fraught with complex document flows, repeated prompts for the submission of personal data in completing even the simplest formalities, and constant changes to legislation. The public servants across the desk devote most of their time to handling documents. What is worse, the documents come in different formats that are difficult to harmonize and require extensive safeguards and administrative procedures. Public servants are forced to grapple with constantly changing legislation and its interpretations. This makes for a very complicated environment that erodes trust between the parties involved. And yet, things could be very different.

Can the chaotic system be changed?

Managing dates of birth and death, civil status information, business registers, tax liability and insurance details takes massive information silos. More importantly, information flow rules must be codified, which is not an easy task in a constantly changing environment. To complicate things even further, individual public administration sectors use their own standards, often incompatible with those applied by other organizations. Even the most innovation-friendly governments find it daunting to manage data flows, process and validate data, and ensure IT security and safe disclosures to multiple parties. Could a universal system simplify data flows between citizens and public administration, offering convenience and a sense of security to both sides? Yes, it could. All that is needed is the political will and a green light from decision-makers. Every institution that handles invoices, documents, access codes and authorization tools should naturally be interested in the opportunities offered by blockchain.

The biggest benefit of blockchain is transparency

What makes public administration unique is its geographical distribution, the huge responsibility it shoulders, its mission and its inherent need for transparency. In one of my previous articles, I have already emphasized that blockchain’s transparency makes it perfectly suited for use in areas where transparency is critical. This is precisely why the technology might be of great interest to public institutions and offices. Not to mention us, the citizens.

Blockchain can also help respect one of the citizen rights enshrined in our political system, namely the right of access to public information. Besides benefitting governmental agencies and people in charge of issuing licenses and administrative authorizations, blockchain could help regular citizens.

It’s very practical application could be to simplify relations between citizens and public administration bodies, protect critical public data and facilitate asset management. Deployed on a mass scale, it would provide every person and organization with access to virtually all the data that concerns them. The most obvious case is that of linking basic personal data with records of previous interactions with organizations and offices, with the respective data stored in an encrypted database. End users could authorize offices to access specified parts of such individual ledgers. Such access could be enabled with cryptographic rules set up in blockchain that would govern the use of public and private keys.

Read full article

. . .

Works cited

Fortune, Robert Hackett, No, JPMorgan Chase CEO Jamie Dimon Has Not Changed His Stance on Bitcoin, link, 2018.

MarketWatch, Aaaron Hankin, Beware these cryptocurrency dangers, say European regulators. Don’t invest money you can’t afford to lose, regulators say, link, 2018.

CoinTelegraph, Molly Jane Zuckerman, Don’t Regulate Crypto, Regulate Financial Institutions, Says EU Banking Authority Chair, link, 2018.

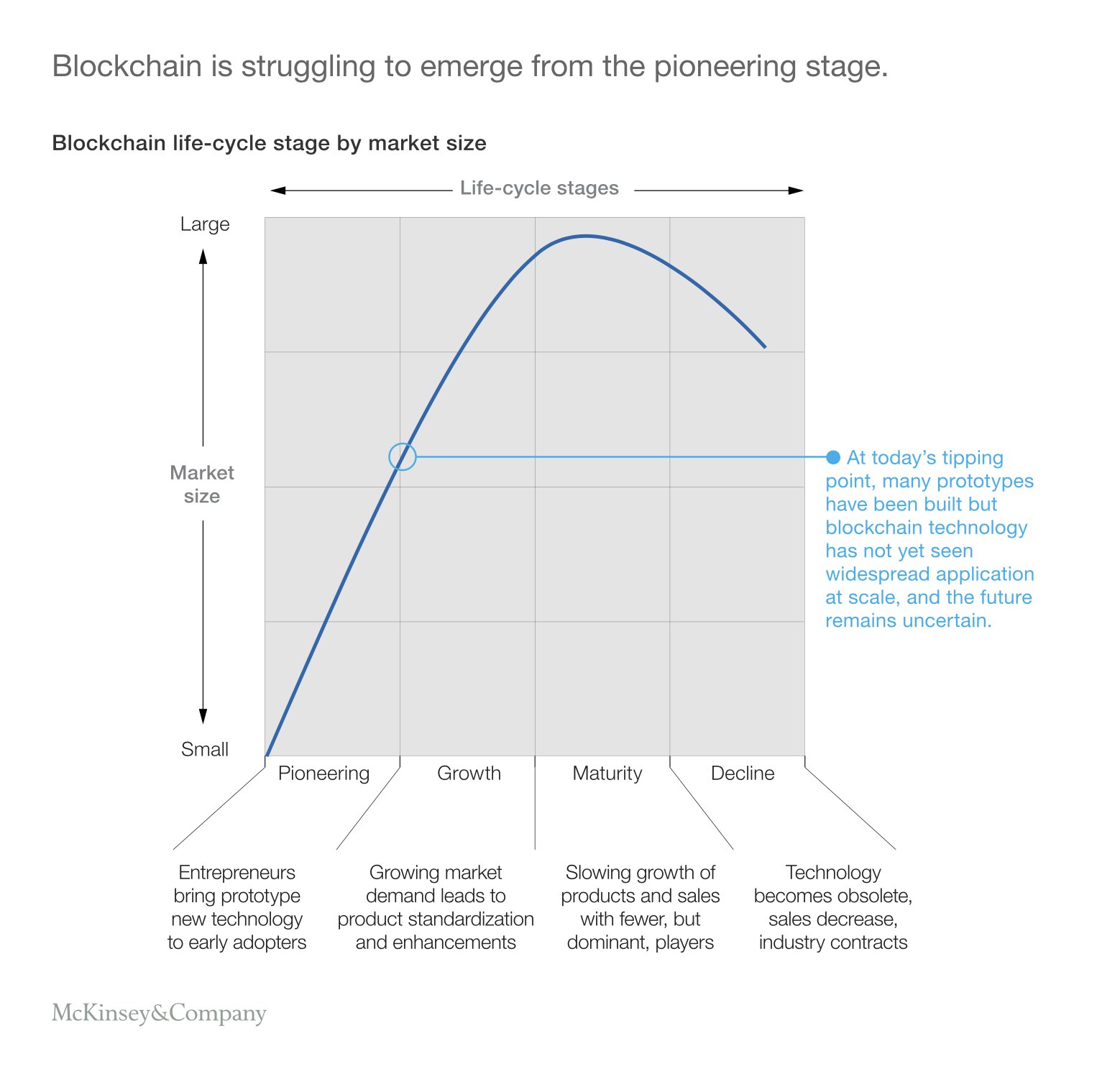

McKinsey Global Institute, Kevin Buehler, Daniele Chiarella, Helmut Heidegger, Matthieu Lemerle, Akash Lal, Jared Moon, Beyond the hype: Blockchains in capital markets, link, 2018.

. . .

Related articles

– Blockchain poised to shake up our lives

– Will quantum computers doom the blockchain?

– Artificial intelligence is a new electricity

– Why do we care about blockchain technology?

Zidan78

I don’t trust people. They’re easily corrupted and emotional. Those who seek power are usually those who want it for personal reasons. From the government to the individual, it’s a fractal pattern of corruption at the expense of others.

Banks employ thousands of people and spend millions of dollars on security and keeping their pockets full. It’s a business, I get it, but if your entire business model revolves around secrets and deception then it’s not really a solid one.

Crypto complely removes the corruption from this equation, 100%. As well as doing away with the need for black box security and thousands of resources dedicated to keeping something physical safe.

In my opinion is the best thing to ever land. I could be wrong but I’ve been in the IT game for 30 years and I’ve never seen anything more needed in this space.

I love hearing well thought-out counter arguments, so please feel free. I’m not living in a bubble of my own ego so please discuss.

TomK

The blockchain is a way of maintaining consensus on a decentralised distributed network. If you have lots of disparate parties with no central authority, how do you make sure they all agree?

That’s where the blockchain comes in. Every time a new “block” is solved it is included in the chain. What goes into a block is just data it can be anything really. The most obvious example is financial transactions i.e. bitcoin.

It maintains consensus because every time a new block is solved (usually every 10 minutes or so), all participants must agree on the state of the blockchain. That’s how it maintains consensus every 10 minutes everyone’s copy of the blockchain updates so they all match. That way all copies march in lockstep, even though there is no one central master copy.

This means its completely unalterable as a historical record. If you take your copy of the blockchain and go back and change something in an earlier block, your copy of the blockchain will simply be rejected in 10 minutes at the next re-sync, because your copy would not match the rest.

Tom Jonezz

This looks like an article from a non-techie trying to write about complicated tech.

The main point of this article is that although Blockchain has existed for quite a few years, we aren’t seeing much real-world use of it.

It’s both not true, and non-consequent.

It’s non-consequent because Blockchain is a young technology, very un-similar to anything we knew before. It’s very complicated even for techies, let alone non-techies.

It would take a few more years to build the infrastructure above which the user applications are going to be built. For now you can only talk about potential.

If the article would have brought provable facts about why Blockchain can’t achieve the targets that it set out to achieve that would be one thing. However, all it tal

Piotr

I see there’s a potential use in payments and in smart contracts (although probably don’t fully understand these) but we can already do payments and contracts pretty well. Why would we want go through a huge upheaval to change it? What are the other potential uses? Please, do explain like I am actually a 5 year old, metaphors about candy etc. are welcome.

johnbuzz3

Hope best. About time

johnbuzz3

Also, it should be said that there are a lot of VCs who have done great things for the tech industry and the world at large. There are also VCs who’ve turned beautiful projects into hollowed shells of despair. Often this happens at the later stages of financing, to prepare for acquisition or a public sale. Then the founders leave and the world is hopefully a tad bit better. Anyways, just to say that not all VCs are evil and often early stage investment is essential. That’s why they’re called “angel” investors, because anyone else would be a fool to bet on early founders with early projects.

Today though, things have changed. In the context of cryptoeconomic communities/platforms, it makes no sense to have VCs invested in a different round than “common folk.” Cryptoeconomic networks are all about community, and if the platform is legit there’s no need special rounds for special investors. *Everyone* wants to get in on a rocket ship. Also, if special interests are favored before the crowd, this reduces the incentives to participate, reducing the value of the network, reducing incentives for investors, reducing the incentive to participate, etc…

Also, the code of these networks can be forked and copied into any other platform. What makes a platform special and unique is the community build around it. Ethereum has something that almost no other platform has, a community. It’s the most valuable asset, and every other projects wants a piece of it. It’s essential to realize this, to appreciate the value the community provides, and to nurture and cultivate it.

Zoeba Jones

Great read Norbert

SimonMcD

I don’t know if we’ll make all that much progress in 2019, but we’ll see. The IoT and smart contracts in many ways go hand in hand. But what we really need is an open source solution.

Adeptus99

I’m impressed. Thanks for sharing this. It’s fascinating how you can find all these information in the data marketplaces nowadays. Thanks to blockchain, there are few projects I know like SciDex, they’re an excellent example for a decentralized solution to scientific data storage and sharing. There is high hope that better things are yet to come which will change data science, making it cheaper, more accessible and more accurate leading to better decision making and more accurate results for companies and consumers alike.

johnbuzz3

In my opinion, there exists no real threat to Ethereum. Most of the competitors are concerned with keeping the illusion last a while longer and make a little more money off it than deliver an actual sustainable product.

All of them from EOS to Cardano will eventually lose market share to new EOSes and Cardanos as the hype and promises fade away. The funny part is their investors realize this is a money grab and still want a piece of the cake.

Adam T

I hope that yes 🙂

Jack23

Blockchain != Bitcoin

Bitcoin == Blockchain

You can do a lot more with the Blockchain technology of immutable records (which it essentially boils down to). Unfortunately, due to poor programming there have been lost a great number of records (in this case cryptocurrency) in the past, because those records were no longer valid.

So, please nobody tell anyone that

a) This is safe to use

b) There can be no error

c) This is the “currency” of the future

Because all of the above is simply and plainly incorrect.

It is not safe, because it is not regulated (no oversight) and bad programming can/will result in you being broke in 10, if you use cryptocurrency.

Of course there can be errors. Mainly for ther reasons above (no oversight) and entire “chains” can be “lost in space” because their backtracking was diluted and/or not properly kept.

Again Blockchain != Bitcoin. Bitcoin aka Cryptocurrecy is the first use of the Blockchain technology (of immutable records). This was mainly (my personal view) to get rich quick on the inventor’s side.. The Blockchain technology is a great way to keep records i.e. for who owns which real estate and to whom was it sold, but it is far from “complete” or “error free”.

Use with caution. You have been warned!

Adeptus99

Robonomics protocol will be developed for usage in new blockchains: EOS, Cardano, Tezos. The main spheres of usage are: Decentralized IoT Data Marketplace, Drones, Industry 4.0, Trackable Supply Chain, Autonomous Service Providers.

Norbert Biedrzycki

Blockchain explained – bitcoin example

Norbert Biedrzycki

Blockchain is struggling to emerge from pioneering age. Still no killer app except crypto @McKinsey

Simon GEE

The first example of a blockchain I have been able to comprehend. Thank you for this 🙂

TomK

Hope that yes. Finally

Karel Doomm2

Bitcoin will continue to struggle to gain any real momentum with the the general population until products and services make it as simple and the misconceived perception becomes less associated with drug crime and theft. Educating the public is key and it may be that total abstraction from bitcoin is needed.

John McLean

I was with you up until you started talking about the Bitcoin exchanges being hacked. C’mon man, it’s a totally different issue to the security of Bitcoin or the blockchain itself.

TomHarber

An actually interesting, well though-out and articulate article on Medium.com? Is this a beginning of a new era?

Tom Jonezz

🙂

TonyHor

Why smart contracts are not actually a solution to every problem. The people who are proclaiming this are con artists. Virtually all the examples this article mentions (Ripple etc), I think ultimately are scams.

That doesn’t mean blockchain has no use. There exist problems that can be effectively contained entirely within it.

ZoraBora

I can be completely wrong, but I read that as an attempt at creating some form of program that is in and of itself the ultimate authority. In other words, whatever the “smart contract” does is exactly what was expected, but all parties. So if the contract does something unexpected, then that was just a misunderstanding of the contract, and the contract has the authority, with no way of reversing the decision.

Under this promise, I would expect anything that happens in a smart contract to be final. If someone get $100 dollars from me, because i didn’t read the “script” correctly, then I lost that money.

In the real world we have consumer protections that make sure that I can get my money back. Ether has shown themselves willing to revert transactions in the past, but I believe that goes against the very core of what they are trying to offer. If they can do whatever they want to the computation, then they become the middleman.

tom lee

Hard to beat some of the heists that are possible with restricted access to trading platforms, like naked short selling. Tokenized access would reduce preferential access and scams requiring it. I think overall it would reduce the scale of the heists possible.

Similar to how bitcoin reduces the reach of the fractional reserve heists that can be pulled by people with banking licenses.

johnbuzz3

You’re making things up, saying words because they feel right in your mouth before you say them, but once you release them into the wild.. they make zero sense.

Go spend 200+ hours watching interviews, lectures and reading papers and publications about Cardano and it’s track record/transparency over the past 2 years.

“They will research as long as they can” .. what does that mean? PoS testnet launch is imminent. Possibly even in a few hours. Jeeze. Lol

JohnE3

Because Visa takes like a 3% fee on all transactions, you have to get approval to set up a bank account, you need to wait days to transfer money between accounts, your money doesn’t work in every country, and if you live in some countries like Greece, Venezuela or Syria your banking system is completely fucked.

DDonovan

I think/guess the term “smart contract” came about because it absolutely, definitely will execute. There’s no stopping it. So to that effect it is a binding contract to do x if y. Add “smart” because it’s programmable and “smart” is a globally recognised prefix for a technology enhanced anything these days.

But as you said it is really just a script.

It is its location, on a forever executing VM, that makes it different to being on a server somewhere. Once you’ve published it you can’t change it, for better or worse.

TommyG

Bob opens a candy shop called “Bob’s Handy Dandy Candy shop” .

He has no idea how taxes and all this adult stuff work so he asks his older brother Charlie (a smart IT guy) to write him a magical SmartContract that cares about everything. He just needs a buyer to show the QR code Charlie gave him.

Alice comes by to buy some chocolate. She scans the QR code with her way to expensive phone and sends the amount to the SmartContract Charlie made.

This contract automatically orders new chocolate and pays for it. The chocolate is already on its way to “Bob’s Handy Dandy Candy shop”. The taxes are calculated and stored in the SmartContract. This cares about paying the taxes and tells the taxman some other stuff in order to make him happy. The rest gets transferred to Bob’s account. This all happens magically and faster as Bob can say “Thank you”.

After the first day he buys a ticket for the film “Frozen” from the money he just earned. He only has to copy the address code which the cinema has on their website. He sends the amount of money and the name of the film to this address. The magical SmartContract of the cinema sends the ticket back.

Bob coincidentally meets Alice in the cinema. Both loved the film.

TommyG

Amazing breakdown.. I would have thrown in a couple smart contract examples too, like a will that self executes with a deadman switch or a simple bet contract using oracalize to confirm who won

And99rew

I agree, the premise of blockchain is not great applied cryptography, that is just a tool that is used to acheive decentralized trust(even if not absolute trust). Sure it has its flaws but like you pointed out, its still an early technology. From a tech POV its nothing groundbreaking but it does provide a paradime shift from centralized to decentralized. Blockchain is trying to create decentralized trust that can be a powerful thing in most systems. I dubit the current blockchains and cryptocoins will survice the test of time. I also agree that theres a lot of gambling with in trading those coins/tokens but it is important to have such stupid amounts of money to finance development of the underlying tech. and explore ideas in different areas of application.

AndrewJo

I agree that it’s no different from trading commodities, but I’d say that it’s a lot closer to trading gold than oil. Oil is at least an important resource to society, as it can be converted to energy.

Gold, on the other hand, is simply valuable because humanity attaches value to it. It’s tempting to call it self-delusion on a massive scale. The simple fact that a significant number of actors attach a high value to gold is enough to make it seem a valuable commodity to be traded and hoarded.

Is the same not true for crypto-currencies? As I see it, crypto-currencies become valuable not because they can be converted to energy (it is, regrettably, rather the other way around: a massive amount of energy is spent on generating crypto-currency from essentially nothing) but rather because an entity is able to convince a critical mass of potential investors that it’s crypto-currency is valuable and thus worth trading and hoarding.

tom lee

Bearer Instrument – Proof of Possession-based. Fully Distributed. Maximum Privacy. Maximized flexibility to transfer and exchange. Can be stolen. Access to trade is mechanically enforced (eg. you put it in a safe, give keys to 3 people, etc.) Think share or bond certificate.

Registered Instrument – Proof of Identity-based. Fully Centralized. Entitled actors can see (brokers, exchanges), so partially-private. No (practical) means to transfer or exchange (I can’t trade my AAPL for a new car). Can’t be stolen. Access to trade is legally enforced. Think ETF or modern stock exchanges.

Registered-Bearer – Proof of Key-based. Fully Distributed. Pseudo-Private. Approximated maximum flexibility (you still have to wait for a deposit to confirm 6-times before you can trade). Can be stolen. Access to trade is programmatically enforced.

I assert Bitcoin, ERC-20, etc, is in the third form. It’s registered on a chain, but the bearer is whoever possessed the key.

CaffD

Because there’s no one in the middle it is closer to a physical transaction. Irreversible. When you give cash to someone it is “final”. He has full power over the cash and if you want him to give it back you have to request it from him. But because it is irreversible it is also in many ways simpler. Cheaper. You don’t need to identify yourself and fill out a form when you give a dollar to buy gum. He doesn’t need to know who you are. You just give it to him. Because it’s physical, you know money has been fully transferred. For the first time it is the same in the digital world because of the blockchain.

johnbuzz3

Many well-known blockchain projects are developed from the open-source (free) code — anyone can freely use the source code to develop their own public or private blockchain system. They can do so without needing an application for a license from somebody and paying anything for the use.

TomHarber

I get irritated at the blockchain movement. The amount compute needed once the chain becomes large will be crippling in cost. Just look at what has happened to bitcoin. You used to be able to use a regular cpus to mine, then gpus, now asics. It has good intentions but wrong tech.

Had a client who was doing some file storage for clients. He said in future versions of the application he would like to see blockchain implemented because it is the new technology. Tech for the sake of tech.

Mac McFisher

It’s open source

Zidan78

Good article, the point about complexity is key. Blockchain solutions are inherently unable to manage complexity because the functionality of trust and institutions whether corporations or governments is to manage the sheer amount of transactions coming in.

I don’t want to sign, read or be bothered with 500 smart contracts a day, and as Coase has told us 70 years ago, there is no such thing as a perfect contract anyway, because we have to incorporate informal structures and novel events we cannot anticipate in contracts. You cannot write perfect contracts because contracts concern the future, and we can only speculate about, but not know the future. And in case of dispute we need an arbiter and authority or else we’re stuck.

If everything was based on a contract there would be no corporations, there would be no government, there would be no safety regulation, because we’d all be signing bilateral contracts all day, and it would probably take up 90% of our time. Of course, that doesn’t work in large communities so we manage complexity through trusted institutions to which we defer tasks.

The selling point of blockchain technology, that it ditches hierarchies and middlemen is deeply flawed. Because hierarchies and middlemen are extremely useful entities to handle information processing.