The disappearance of cash

Work, transportation, medicine, shopping, entertainment – digital technologies impact all of these and just about every other aspect of our lives. In recent years, people’s approach to physical money has also been changing. Cash is no longer king. Whether we like it or not, a wallet bulging with cash is becoming a thing of the past. Power has passed to electronic transactions, Internet transfers, virtual money transactions, payment cards and virtual wallets. The world is moving ever closer to becoming a cashless society.

However, the growing dominance of commercial chains and the elimination of cash transactions is giving state governments, supervisory institutions and tax authorities the ability to monitor our transaction and purchase histories, as well as to follow our buying preferences, and shopping patterns and habits. They are gaining greater control and eliminating the gray market.

The banking era before the advent of cryptocurrencies

The key pillars of a cashless society are systems, tools, platforms and legal regulations. These make it possible to digitize the circulation of goods, services and money. Despite continuing advances in the level of sophistication of various forms of cashless exchange, the biggest barriers today to a cashless society are the major financial institutions. The reason is simple – modern means of exchange undermine their status. In the future, the importance of today’s major financial institutions may be substantially reduced, or even marginalized.

When it launched the first credit card in 1958, little did the leaders of Bank of America know they had sparked a revolution that would wipe out paper checks, which at the time accounted for 80% of financial transactions. Similarly, when opening the first automated teller machine in 1971, MasterCard had no inkling it was establishing a new channel for customer relations that would eventually allow people to use banking services without visiting bank branches. Later, text messages in cellular phones gave rise to mobile banking, which – thanks to the WAP technology in smartphones – has grown into the mobile banking we know today. However, each of these innovations was developed either by financial institutions themselves or with their direct involvement.

The birth of the blockchain and the creeping rise of cryptocurrencies

2008 was the year blockchain was born. At its heart, the blockchain technology is a means for maintaining a shared collective ledger of transactions concluded between computers. The digital ledger is dispersed across the entire web in identical copies. Open to all, it is nevertheless fully secured with advanced cryptography. Users are only allowed to access their own transactions.

Then came bitcoin, a truly digital currency. Suddenly, it became clear that commercial exchanges, settlements and money flows could all proceed safely without the help of the existing financial system. Their role could be assumed by public channels, the Internet, generally available shared transaction ledgers and blockchain-based transaction authentication systems. Bitcoin is an electronic currency, a cryptocurrency. Having bitcoin data recorded in a chain of blocks prevents the duplication of even a single bitcoin. All transactions are public, and their entire history is available for viewing and verification. The blockchains that serve as transaction ledgers cannot be counterfeited due to a cap placed on the number of bitcoins and protections that prevent their number from ever exceeding a predetermined ceiling. The transactions recorded in a blockchain are also irreversible.

I presume that when the founder of blockchain Satoshi Nakamoto announced in October 2008 his idea (which is what he then called it) to create a new entirely-peer-to-peer electronic cashless system that would eliminate third-party fiduciaries, he never suspected he was starting a revolution that would wipe out the financial system as we know it today and transform its fundamental operating principles.

Blockchain and the blockchain-based cryptocurrency bitcoin is the first financial system invention developed outside of financial institutions without even the slightest contribution on their part. It is novel, simple and completely independent of the existing financial system. The phasing in of blockchain will thoroughly influence not only the financial services sector, but also a whole range of commercial operations across the world.

How much is bitcoin worth?

One of the obstacles to the widespread use of cryptocurrencies is the issue of valuation. Bitcoins have a value because of the steadily growing number of people who are confident that the technology that underpins it, i.e. blockchain, is valuable. In the future, bitcoin technology may be used in a wide range of applications in the financial services sector for transactions, settlements, contracting, share trading, currency conversion and stock exchange management. Contrary to existing conventional currencies, whose real value may be raised or reduced at the discretion of central banks, there can only be a finite number of bitcoins. Theoretically, this means that the currency is safe from manipulation, deflation or inflation. Although with each year passing, bitcoin is becoming a fully-fledged means of exchange recognized by state governments, its value is being created by the buyers who choose to use bitcoins for their transactions. In other words, bitcoin is only worth as much as it is widespread. And although I can’t use it today to pay for a hamburger in any restaurant in Warsaw, Paris or New York City, I will increasingly be able to do so in the future.

Easy transaction handling, system capacity

Changes in the global financial model, the resulting reluctance of financial institution to accept bitcoin, and the limited availability of places that accept cryptocurrency transactions, all hamper blockchain’s expansion. However, slowly but surely, financial institutions are jumping on the bandwagon and joining the revolution, some because they have become aware of the new trend and the emergence of this new market; others because they know their significance is bound to diminish in the near future unless they do. Similarly, the number of physical and virtual places that accept the cryptocurrency is growing steadily. The greatest potential hindrance looking forward may lie in the processing capacity of the global blockchain system and how easy it is going to be to have bitcoin transactions supported, if they are supported at all.

One of the stages in designing and testing complex systems are stress tests, i.e. performance tests run at what is expected to be the maximum load. Note that in relation to the bitcoin system, which spans the globe, such tests would have to target its dispersed data processing sites, and, in fact the entire Internet, with a range of conventional peer-to-peer networks. Unfortunately, tests have found that bitcoin is unable to support capacities greater than 20 transactions per second (TPS). Visa and PayPal, for instance, handle an average of 2000 TPS and 115 TPS respectively. This may be a problem of system scalability, or of the relatively young age of the blockchain network compared to that operated by Visa. Either way, the network’s capacity lags far behind those available to the existing financial systems. The answer may thus be not only to gradually increase the computational power of network nodes, but also to enlarge blockchain blocks from 1MB to 2 or even 5 MB. This would require a technological modification of the algorithms that support blockchain management, computing and encoding.

Neither is the ease of transaction handling anywhere close to ideal. Due to the high complexity of the mathematical management and control algorithms in use, blockchain technology is difficult to manage and operate. It takes highly advanced knowledge to write even the simplest of applications. The same goes for bitcoin. Not only is it complex, being a cryptocurrency, it also comes with confined availability limited by exchange points, network nodes, the places that accept the cryptocurrency, stock exchanges and the entire financial ecosystem. Granted, the system is growing rapidly. Nevertheless, were I to go on a proverbial trip around the world, I would rather bring a payment card loaded with US dollars and euros than virtual bitcoins. This said, it is nevertheless true that Felix Weiss circumvented the globe in 2015 crossing 27 countries while relying exclusively on the cryptocurrency to pay his way.

Creating new blocks in the blockchain

The fundamental idea about the blockchain is to create new blocks for transaction sets by arranging them into blockchains and sending them into the network. Across the entire network, a new block with 1 MB of authorized transactions is created at an average frequency of one every 10 minutes. New block creation is referred to as mining (to mining of gold). It is managed by specialized network nodes which are high capacity computers. Since the entire blockchain network relies on peer-to-peer transactions, and there is no specialized data processing hub paid to keep the system running, everyone who owns a computer with the required capacity may, once they are authorized in the network, engage in creating new blocks that store a list of authorized transactions. As the process is highly complex and requires powerful computers, such network nodes are rewarded or paid for with bitcoin.

The rewards are to help retain miners and ensure that blockchain network transactions are created, authorized and set up in the blockchain with a certain regularity. Currently, the blockchain community considers the reward system to be sufficiently high to offset the network and network node maintenance costs incurred by computer owners. However, as is the case with any other currency, bitcoin may appreciate or depreciate rapidly and substantially. It is entirely plausible that bitcoin will depreciate to the point where it can no longer pay for network maintenance. Meanwhile, creating new blocks in the blockchain network is becoming increasingly more difficult as many maintainers are forced to acquire specialized equipment and software.

Needless to say, the moment new block creation ceases, the network will grind to a halt, deprived of its ability to send transactions. Understandably, the prospect is unnerving to major organizations that have considered switching their business to blockchain. On the other hand, new alternative systems to manage block creation are being developed. Contrary to their predecessors, they are going to be based on accurately defined SLAs managed by private institutions offering adequate rewards to network block creators and transaction managers. Unfortunately, the new system’s tradeoffs compromise the blockchain ideal of running a decentralized self-regulating peer-to-peer network.

What’s the next step towards creating a cashless society?

Blockchain is not humanity’s last word in creating decentralized financial systems that are globally accessible and independent of state governments, stock exchanges, financial institutions, banks and other middlemen. The current sophistication of blockchains and cryptocurrencies and the innovations they have sparked suggest we are on the right track to creating a truly independent financial system. Will it be ideal? Time will tell. However, what is almost certain is that the precepts of blockchain will help humanity develop new systems and safe transaction protocols and bring it closer to realizing the vision of a truly digital cashless society.

New technologies like blockchain have enabled small organizations, small businesses and individuals willing to make a relatively small investment to upset the fundamental operating principles that underpin economies and shake up a well-entrenched and firmly-established global financial system. There is another phenomenon related to this development that Satoshi Nakamoto had no way of predicting: the devaluation of patents. When it comes to patents, blockchain competes against a financial system backed by powerful state governments. Patent rights can hardly stand up to the power wielded by global organizations and national governments. Elon Musk, the founder and author of SpaceX – a company, concept and technology that includes a whole array of innovations that allow spacecraft to return to Earth and be reused – says he is not patenting his inventions and innovations due to the fact that he is competing against governments. The way today’s system is stacked up, patents offer no protection whatsoever. Pitted against a global financial system backed by state authorities, blockchain is in a similar position.

Related articles:

– What is blockchain? All you need to know

– What are the bitcoins? All you need to know

– Technology putting pressure on business – this is what we can expect in 2017 (part 1 of 4)

– Blockchain has a potential to upend the key pillars of our society

– Synthetic biology. Matrix, Dolly the Sheep and the bacteria of the future

– Blockchain – the Holy Grail of the financial system?

– Fall of the hierarchy. Who really rules in your company?

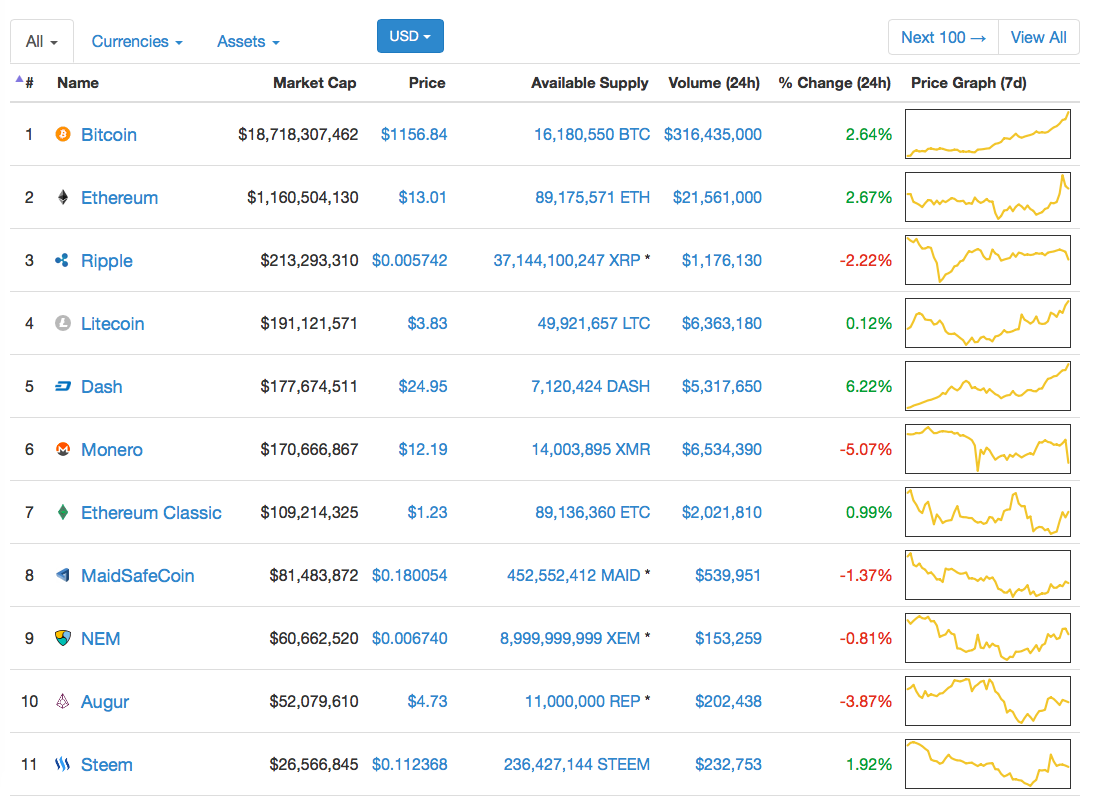

Cryptocurreny market share and capitalization (dated: 24 Feb 2017) https://coinmarketcap.com

Example of public cryptocurrencies

Oscar2

Blockchain is immutable. Reality: Blockchain uses immutable data structures. You might want to clarify how those 2 opposing statements (back to back) are both true.

Please do read our response to this great article!

https://gospel.tech/mckinsey-gospel-blockchain-beyond-the-hype/

AdaZombie

By including identity (either tokenized or privacy protection layer) we can allow regulatory controls over the movement of the value.

TomK

Financial Services is expecting Smart Contracts to be a container for the execution of financial business transactions. These containers need stronger security and identity to assure all parties are known, trusted. Existing business models can be coded into Smart Contracts to accelerate the value of money.

AndrewJo

Identity and security layering will be required that trust (ie access to manipulate underlying assets), is granted only to bits of contacts/ledgers that need to interoperate

SimonMcD

Nice

Although forgery of documents is a concern/problem and DLT, along with blockchain (1st Gen DLT), can provide an immutable and secure platform to store PII data, oracles (entry points of data onto a distributed ledger) can be compromised.

If PII is controlled solely by a corrupt gov’t and does not allow for varification by the person to which the PII belongs, then this leads to potential forgery by the corrupt gov’t for nefarious purposes of the corrupt gov’t. China, Iran, NoKo, Venezuela, and many other countries come to mind that could/would manipulate a global or country-wide identity distributed ledger ID system for their own gain and control (i.e., labeling someone a terrorist who simply doesn’t agree with the views of a country). “Power corrupts, but absolute power corrupts absolutely.” (Lord Acton)

TomCat

It’s ~50%, and after one use, it’s 128 bit security, which is equivalent to Bitcoin’s security. It’s statistically possible for it to be higher or lower. https://iota.stackexchange.com/questions/245/what-information-is-leaked-if-i-reuse-an-address

I guess you are insinuating that this is a bad tradeoff for quantum security? If so, I’d like to point out that wallets can be automated to deal with the issue and permanent address solutions are being created, so it’s a temporary inconvenience for a long term security measure. My guess is other coins will have to find solutions once quantum computers come online, and unless they have a plan in place and tested, they won’t have much time in which to work–as we are seeing with BLT it may have effects on other parts of coin design, so kicking the can down the road in hopes that quantum computers are a distant problem may not be the wiser option.

Adam Spikey

For the purpose of this article you should replace Blockchain with DLT (Distributed Ledger Technology). DLT is:

– A ledger that generally runs in a hostile environment like the public internet

– It uses cryptography to try and solve identity and ownership problems in this public environment

TomHarber

Blockchain technology is decentralized by design. It lacks centralized points of vulnerability that can be easily exploited by hackers, and depends on encryption technology in the place of the conventional username-password security system. A user accesses his account through a randomly generated private key. Another feature to take note is that it is transparent, as it is a public record of activities that can be seen by all participants. It has the capacity to automatically update itself every ten minutes and reconciles any transaction that occurred within that time interval.

Adam Spark Two

Crypto is an intersection of multiple disciplines, Nick Szabo has been talking about Smart Contracts since at least the mid 90s: http://www.fon.hum.uva.nl/rob/Courses/InformationInSpeech/CDROM/Literature/LOTwinterschool2006/szabo.best.vwh.net/smart_contracts_2.html

The concept of eCash has been discussed for a long time too e.g. see this by the NSA (National Security Agency) from 96: https://groups.csail.mit.edu/mac/classes/6.805/articles/money/nsamint/nsamint.htm

There were a number of precursors to this, I just have these two links to hand.

Norbert Biedrzycki

Established banking industry is pouring money into blockchain technology far faster and more steadily, and a likely target of $$400 million during 2019.

Adam Spark Two

Check this one out: https://mck.co/2GZh8iP

johnbuzz3

Majority of the capital market industry is focused on development of private/permissioned DLT that will never allow an Internet based browser access to these private networks. Access will likely occur via proprietary applications or proprietarty+embedded Webkit technology. By linking credentials to individuals, individuals and assets to corporate entities we can create unique cryptographic identification tagging to tradable instruments. Wrapped within a permissioned based privacy friendly security layer it will allow association of people and assets within a hostile environment (such as a public Blockchain running on the internet). This will allow authorized parties to utilize mathematical forensics to trace the chains of ownership yet prevent regulatory snooping.

Oscar2

I would not claim that blockchain is 100% secure. It is secure taking into consideration current state of technology and knowledge. For example, the quantum computers can change the rules across the blockchain space. What is more, if someone, let’s theoretically say a genius is hiding in a basement somewhere in the Northern Siberia, finds a methodology to decipher the currently used hashing functions (sha256 and sha512 being two most recognized), the blockchain as a reference data proof machine will be invalid.

Of course, these are only theoretical considerations, but still, I would not crawl into the narrative of the absolutes.

What makes me wonder is stating that blockchain is better than the traditional databases; it is not, it is different. It has the entirely different purpose of existence. Secondly, in the first sentence, the article is noting that Bitcoin is just one iteration of blockchain (cryptocurrency network), while the author is referring to the Proof-of-Work type consensus which is strictly linked to the two largest cryptocurrencies: Ethereum and Bitcoin.

Norbert Biedrzycki

Recent deveolopment on bitcoin: German central bank warns people not to buy bitcoin as price skyrockets: http://snip.ly/k7clc

johnbuzz3

Banks/central banks/financial institutions/money related organizations and all are backed by physical gold/paper cash, one significant advantages of bitcoin that is virtual in nature there is nothing physically attached to it and everything just depends on the security of private key, it is a cryptography method that keeps everything a secret which goes back to ancient Greece times. Bitcoin is the first of it’s kind, it’s a currency and a bank at the same levels, actually there is no bitcoin outside of a private key’s vault it’s more like a mobile Swiss bank also you need to have the money first to deposit in a bank but with BTC you are supposed to mine it and create money by doing so.

Adam T

Very interesting point of view

Mac McFisher

Financial Institutions are faced with much higher regulatory, compliance costs as well as strict restrictions around capital exposure. These institutions are looking for innovative ways to reduce future regulatory and compliance costs as well as optimally manage their existing capital to generate new revenue streams.

DDonovan

Today’s Bitcoin could be ‘tomorrow’s Beanie Babies’: Schiff : http://video.cnbc.com/gallery/?video=3000596750

Mac McFisher

Hi, I’m new to these ideas of the block chain, but I have watched a few videos on YouTube explaining it and mentioning that the technology can be applied across industries, like Pharma and food.

My question is for Pharma and food, it seems that one use of the block chain would be to know the history and original (supply chain history) of the drug or food. How would we link the physical good with the identification in the block chain? Counterfeit could still be possible if it is just a simple label with a barcode on a sticker, right?

TomK

I believe you’re right. But just tink about potential application of this technology in other industries as well. No limits

John McLean

Like what? Energy distribution, obviously Fintech and banking, secure sharing of documents, rights and ownership …

Karel Doomm2

What does “peer-to-peer, decentralized, append-only database” mean?

You probably know what a “database” is. Some people say it is sort of like an Excel spreadsheet. In the case of Bitcoin, the spreadsheet contains information about Bitcoin Wallets, which are like bank accounts.

“Append-only” means it is a database that you can add information to it, but you can never change the information that was added to it, and you can never take information away. This is important because you don’t want people cheating by changing information in the past to make it look like you have more Bitcoin money than you actually bought.

“Decentralized” means copies of the database exists on many, many different computers, and all of these computers can append information to the database. When new information is appended, the new information is copied to all of the computers.

“Peer-to-peer” means the database is not owned by any one company or person. Anyone can create a copy of the database and use the network. Everyone who has a copy of the database and connects to the network is an owner of the database.

Basically, blockchains are a technology, and like all other technologies, it can be used to solve various problems. Bitcoin is just one place where a blockchain is used.

Also, in my opinion, Bitcoin and crypto-currency is a waste of time and electricity, and I don’t think it will be very valuable for very long, it will probably suffer an economic crash in the near future. However the blockchain technology for Bitcoin is very interesting.

AndrewJo

An individual, or an entity’s identity can be stored in an Identity Provider and utilized on the blockchain, ensuring secure and rapid ID authentication without the warehousing of sensitive data at third-party repositories. This will allow KYC/AML information to be directly propagated via DLT yet still protect the privacy of the individual

Jack23

Blockchain != Bitcoin

Bitcoin == Blockchain

You can do a lot more with the Blockchain technology of immutable records (which it essentially boils down to). Unfortunately, due to poor programming there have been lost a great number of records (in this case cryptocurrency) in the past, because those records were no longer valid.

So, please nobody tell anyone that

a) This is safe to use

b) There can be no error

c) This is the “currency” of the future

Because all of the above is simply and plainly incorrect.

It is not safe, because it is not regulated (no oversight) and bad programming can/will result in you being broke in 10, if you use cryptocurrency.

Of course there can be errors. Mainly for ther reasons above (no oversight) and entire “chains” can be “lost in space” because their backtracking was diluted and/or not properly kept.

Again Blockchain != Bitcoin. Bitcoin aka Cryptocurrecy is the first use of the Blockchain technology (of immutable records). This was mainly (my personal view) to get rich quick on the inventor’s side.. The Blockchain technology is a great way to keep records i.e. for who owns which real estate and to whom was it sold, but it is far from “complete” or “error free”.

Use with caution. You have been warned!

DDonovan

Blockchain has enormous potential also in many other segments, not only finances. Smart Contracts, which are based on the blockchain ethereum protocol, can help in the disgustingly complex system of settlements between the streaming platform and the artist. There are many blockchains – practically every cryptocurrency is a different blockchain. There are many applications for Fintech, banking, supply chain. This is definitely a huge future. And all in all it’s simple enough that a distributed and secure database.

johnbuzz3

This can only occur if the transactions themselves are tied back to real world identities yet layered with security mechanisms that protect the privacy yet allow role based regulatory insight into the transactions themselves

TommyG

SegWit is a proposed soft-forking change to the Bitcoin protocol that, among other things, increases capacity of the network. In addition to an estimated doubling of the block size limit, SegWit is also viewed as a key improvement for layer-two solutions such as the lightning network and TumbleBit.

JohnE3

It can not be concealed that blockchains and cryptocurrencies are new and conservatives tend to celebrate such inventions with a wide arc, but there are many wealthy people who are very interested in this technology, because even if it enables being anonymous. Even Bill Gates himself admitted to having BTC during one of the interviews. And the Winklevoss brothers and their investments in the crypto? For 10-20 years, cryptocurrencies may forget and maybe conquer the world like email or the internet.

Norbert Biedrzycki

way faster

John Accural

In financial sector, chains of custody of a financial instrument is deeply regulated territory. This chain of custody is a very costly legacy process. The only way to speed this up is to securely & privately embed chains of identity/ownership into the very process. So, without proper Identity it will be possible for bad actors to continue to create the same chaos thats occurring today. You will need to be securely authenticated with the system and have the proper access controls to the information.

CabbH

it’s a reality that Blockchain is changing the way we interact with each other, nevertheless being more specify, what do you think are going to be the changes to the economic system with the blockchain emergence in a short term? It’s hard to predict the short term period, but in the long term, you can see that we’re running into a cashless society.

They tried to force people use plastic, so they achieve a cashless/powerless society, but it didn’t work as they wanted it to work.

I believe blockchain wasn’t made by an individual, but an organization. There’s a lot of people who’ll disagree with me, or agree, but this is just my opinion.

Norbert Biedrzycki

What about other crypto currencies? Like Citicoin as a example of closed pool, not public?

Norbert Biedrzycki

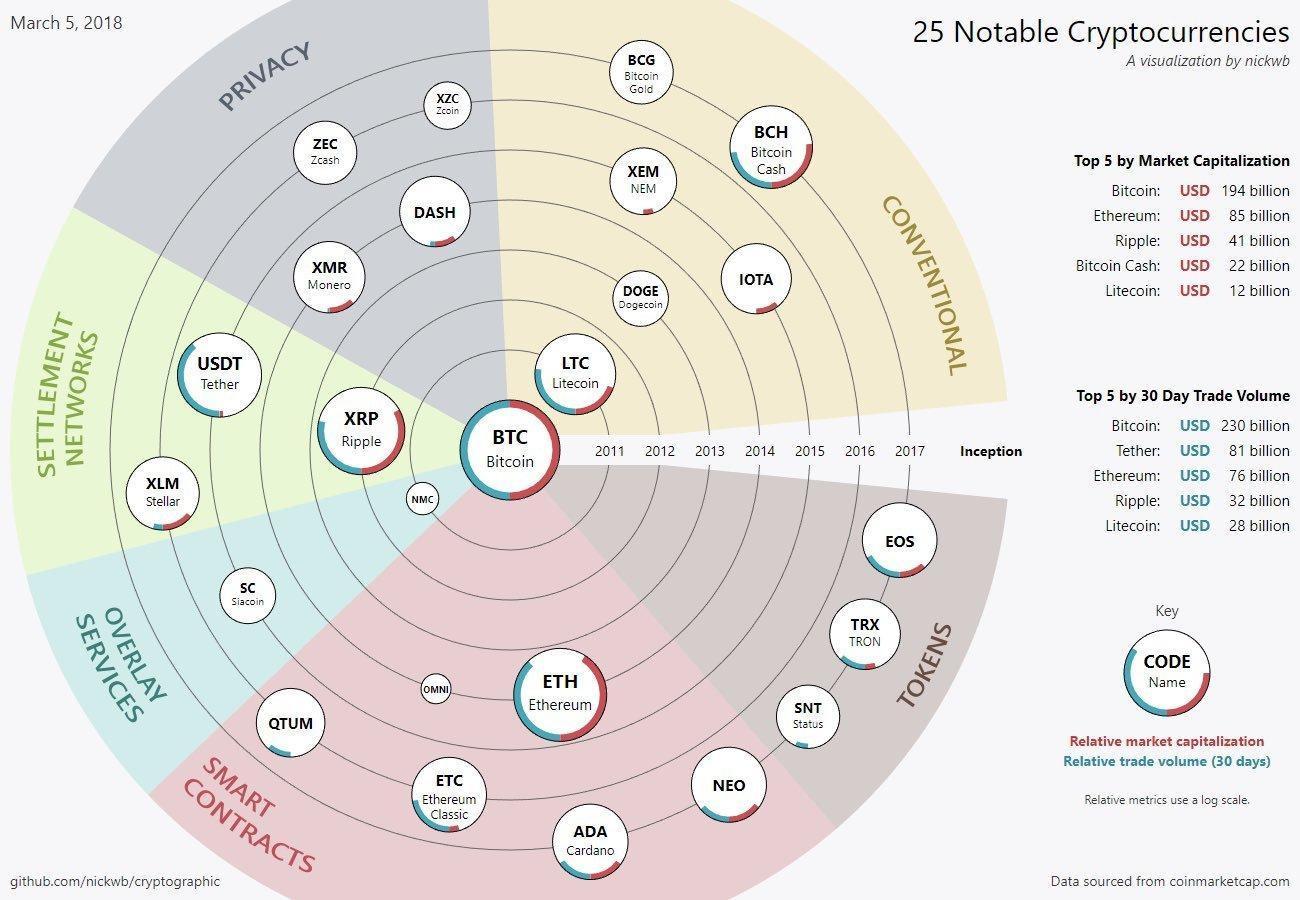

Classifications of Notable Cryptos

TonyHor

I actuall agree. You’re right. We cannot predict but long term I see clear adancement of blockchain vs old traditional fin system

JohnE3

What about financing? There are countries, like the US, with strong capital market regulations, where in many places ICO does not fit. There were many different opinions, but one common foot – ICOs should have and even must have be regulated. There is a long road paved with regulations ahead of ICO to become a safe investing instrument. But as they said, it needs to be done if ICOs and cryptocurrencies are to become safe and useful.

johnbuzz3

Some people claim that AI is threatening humanity. We think that blockchain can stop that, because AI is actually not that intelligent at the moment, so the threat is relatively low. But in a decade, two decades, AI will be really strong, a lot stronger than it is now. When AI is running on blockchain, on smart contracts, we can refrain AI. For example, we can write a blockchain algorithm to restrain the computational power of AI and keep it from acting on its own.

Don Fisher

If you have one of the few very large blockchains, then it’s not easy for someone to control 51% of the processing power. But it is possible and it has been done.

My point was that for any small blockchain (other than, say Bitcoin or etherium), there is no security at all, because you can just rent 10,000 machines from AWS or GCP for a day and take over any small blockchain.

Jack666

There is a more important underlying question here that I don’t think a lot of people have thought about. If someone does break elliptic curve digital signature algorithm (ECDSA) they will be able to steal a significant amount of coins from users on the bitcoin network. This would be obvious grounds for a hard fork — these funds were stolen because of a flaw in the bitcoin protocol (this is different than ETH because ETH’s funds were stolen from a smart contract on top of the ETH protocol).

TomK

Imagine owning money that you could use anywhere in the world without the hassle or costs of foreign exchange rates – possible future when bitcoins are available across the golbe. Interesting would be to see new role of ATM in this process. In this new system, not only would you be able to safely store your money, but you could also send any amount to any individual or business anywhere in the world, instantly and nearly free of charge. This is what I like in crypto currencies

TomCat

The blockchain is a ledger with transactions. Transaction confirmation can be done without centralized system. That’s the beauty of the blockchain. Fin system could crash but legers should stay forever. Another question is if blockchain increasing popularity (rather bitcoins) might cause the crash of a whole financial system. Don’t think so

Norbert Biedrzycki

I think that they will evolve towards cooperation

Jack666

Many financial instruments are asset backed. The algorithmic version of “hard linking of the verified assets to the instruments/securities” and placing on a DLT will allow automation reconciliation of the accounts and instrument repricing. This will add a strong level of operational resiliency to capital markets utilizing asset linking to other instruments.