Many believe that new tool could be the blockchain, with the new currency, the Bitcoin, based on it. Could they put an end to the volatility and opacity of the financial sector? Today, cryptocurrencies are on everyone’s lips, with blockchain – a distributed peer-to-peer database – growing in its shadow, promising radical change.

This could be the first time that a change in global finance comes from outside central banks, stock exchanges, and politicians.

The blockchain paradox

I have written previously about how blockchain can influence financial operations. Its working principle makes it ideal for a wide range of transactions. Blockchain transactions are always encoded, protected with a private key that’s impossible to counterfeit. There are no middlemen as transactions are conducted directly between parties as in any other peer-to-peer system. There is no need for a central organization to establish standards or issue certificates.

Blockchain forms the core of all known cryptocurrencies, offering support for instant money transfers, payment systems and smart contracts. As such, it is poised to take a substantial piece of the pie away from banks, financial oversight institutions and other intermediaries. Unsurprisingly, financial institutions, threatened by a design that keeps intermediaries and regulators out of the loop, are not eager to give up their privileged and profitable positions. For example, JPMorgan Chase CEO Jamie Dimon last year famously called Bitcoin “a fraud.” This year, he says he’s “not interested that much in the subject at all.”

For someone who’s “not interested,” he sure talks about it a lot.

Blockchain: Threat or menace?

Governments, however, areinterested, issuing multiple statements about how they intend to handle cryptocurrencies. The European Securities and Markets Authorities (ESMA), the guardian of the security of the Europe’s financial markets, has called the cryptocurrency market a dangerous place. The European Banking Authority (EBA) would like to prohibit banks from holding, selling or trading cryptocurrencies. Of course, this weighs heavily on cryptocurrency exchange rates and causes a lot of anxiety for the currency’s holders. But as cryptocurrencies raise a growing number of concerns, the blockchain technology is being more favorably regarded.

According to the World Economic Forum, by 2025, a majority of financial executives expect 10% of global GDP to be stored on the blockchain. The consultancy Aite Group projects that the financial industry will invest US$800 million in blockchain implementation in 2018 and 2019. The world’s largest financial institutions are now testing the application of blockchain for swaps, which are highly complex financial transactions. The Australian Stock Exchange (ASX) wants to use it for clearing transactions. The possibilities inherent in blockchain are also being explored by Nasdaq.

So, if financial institutions consider blockchain a threat, why are they investing in it?

Reducing fraud and costs

Blockchain relies on a distributed network of computers owned by multiple users. A distributed network of this kind is highly secure. In the blockchain, there’s no central storage (that can be hacked) or intermediaries. In a traditional system, intermediaries are responsible for a large proportion of cases of fraud and less serious irregularities. After all, there are a lot of them and they often operate in obscurity. Their absence greatly reduces the risks involved in all kinds of transactions between customers and organizations. Blockchain architecture also allows banks to cut their operating expenses. They can generate massive savings in the clearing of transactions among them. According to Autonomous Research, blockchain may reduce transaction clearing costs by nearly a third, or US$16 billion per annum.

Smarter contracts

Blockchain makes a universal tool that automatically delivers on contractual and transaction terms as soon as specified conditions are met. In the blockchain ecosystem, applications ensure that specific tasks are only performed once the complete set of relevant conditions have been satisfied. Briefly put, the process relies on the IF – THEN – WHEN command. An algorithm is conditionally prompted to conduct a transaction. Any two users who neither know nor see each other but who nevertheless wish to conclude a mutual contract securely may choose the smart contract option. Their transactions will be concluded as soon as and only if both parties apply unique codes, i.e., a private and a public key.

This mechanism eliminates errors, ambiguities and manipulation from contracts concluded by users. Smart contracts save time and increase trust among users while removing such parties such as lawyers and notaries public from the picture. Little room remains for the type of manipulation that requires lawyers to sort out or adjudicate.

Global change

In its overview of the possibilities generated by the new technology for the financial industry, McKinsey Global Institute notes that some of the solutions proposed for this new tool may be difficult for the financial sector to accept. In Beyond the Hype. Blockchains in Capital Markets, the Institute points out a characteristic which the advocates of the blockchain technology see as vital: the irreversibility of transactions once they have been made. According to the report, this feature may spell major trouble for banks. Appeal mechanisms are important to many customers. The report also suggests that Bitcoin is not an unmitigated good. Blockchain confirmation times are slow (10 minutes) to allow the synchronization of the network, which runs counter to the financial system’s need for speed, and it requires an enormous amount of computing power, clogging up the financial system’s networks. Indeed, Bitcoin, hyped as an ideal product, may not shine all that brightly when considering its practicality as a currency.

An alternative i.e. the mainstream

Despite these reservations, I still believe we are setting out on a very interesting journey. And there is no turning back. Perhaps we are witnessing a repeat of the history of Linux, an operating system conceived as an alternative to commercial products which itself grew to become a part of many commercial projects. The same may apply to blockchain. After heated debates, it is most likely to become a standard solution for large companies, banks and even governments.

In fact, I think that change is imminent.

. . .

Works cited

Fortune, Robert Hackett, No, JPMorgan Chase CEO Jamie Dimon Has Not Changed His Stance on Bitcoin, link, 2018.

MarketWatch, Aaaron Hankin, Beware these cryptocurrency dangers, say European regulators. Don’t invest money you can’t afford to lose, regulators say, link, 2018.

CoinTelegraph, Molly Jane Zuckerman, Don’t Regulate Crypto, Regulate Financial Institutions, Says EU Banking Authority Chair, link, 2018.

NextBigFuture, Brian Wang, Oracle sees 10% of global GDP stored in blockchain by 2027, link, 2018.

Next, #BLOCKCHAIN Back-office block-buster, link, 2018.

McKinsey Global Institute, Kevin Buehler, Daniele Chiarella, Helmut Heidegger, Matthieu Lemerle, Akash Lal, Jared Moon, Beyond the hype: Blockchains in capital markets, link, 2018.

. . .

Related articles

– Blockchain poised to shake up our lives

– Will quantum computers doom the blockchain?

– Artificial intelligence is a new electricity

– Why do we care about blockchain technology?

AndrewJo

Awesome post! Thank you Norbert!

Oscar P

Good article

Oscar P

The problem with traditionally built trust is that it is hard to do, and people lie. How are you supposed to convince people, as a no-name nobody, that you won’t just run off with their money? You basically can’t. People will just overlook you and turn to the Paypals and Amazons of the world. But with smart contracts, you can make it literally impossible to take the money, and prove that it is that way. It provides a possibility to bootstrap trust, even in inherently trust-hostile environments. That is a genuinely valuable and disruptive thing.

Zidan78

A friend of mine was explaining the idea of smart contracts to me and started with “imagine that you wrote a contract as a bit of code and both people looked at it and were confident that it did was it was supposed to.” I had to stop him there. That hypothetical is absolutely impossible. I do this professionally, and most of my job is figuring out that the code that I thought I understood and tested and checked thoroughly didn’t 100% do what it was supposed to. And that’s without adding in the fact that the person who wrote the code will probably try to hide some behavior I’m not aware of. And this is how everyone is supposed to deal with contracts?

TomCat

Now, the cryptocurrency startups are even worse, it’s true. But the idea that we need transparent proofs of our trust in the integrity of financial systems is super duper real. The points that OP made about blockchain technology not meeting those needs are entirely valid, but “we need to trust each other” is simply not helpful without another solution that provides these transparent proofs.

I agree that decentralized trust systems which require a high degree of technical skill to validate – or even just use – are worse than trusting a third party. If it didn’t work for GPG I don’t understand why people think it will work for cryptocurrency.

Adam Spark Two

While there are a number of things in this article I’d like to comment on, this quote from the article actually concerns me: “All information used to identify citizens and any other citizen-related data could be kept in a single global decentralized blockchain-based peer-to-peer database. Forging a document would require breaking into and modifying a blockchain, which is practically impossible.”

TomK

Norbert – good stuff. Thanks

Tom Jonezz

He’s got some good points. Blockchain technologies are definitely being overutilized in systems where there are better solutions, however some of his arguments don’t make sense, or are criticizing things related to blockchain only tangentially. He seems to be arguing that blockchain as a technology is not useful, which seems like a huge over reaction considering in the beginning of the article he accurately states the problem it does solve. It’s unclear what his agenda is here… it seems just to cast some doubt on blockchain tech and crypto in general. I think he could have done a much better job had he tried to be more fair. From what I can tell he is sick of all the hype and just threw every argument against blockchain into this article without considering if it made sense… ironically the same trap many blockchain enthusiasts fall into.

TomK

In the technology world, there’s a hype cycle for different sorts of products. There’s an initial fast growth period that peaks out, then the market for it kind of collapses since the companies that were just “doing something with X hot technology” burn out their available funds and either find something else to do or close up shop. That creates a glut of developers or engineers who know a lot about the technology, with very few companies looking for that talent. Those people end up finding other sorts of work to do, but they don’t actually forget that expertise.

And that’s where the second stage happens—when hot new technologies find applications outside of tech startups. This can be thought of as the actual productive stage of a technology’s hype cycle. Those developers and engineers move on to other things, and some of them discover that the hot new technology that just crashed and burned might have some real productive uses the startups didn’t consider.

Virtual reality has entered that sort of phase—it’s not really the gaming phenomena that people expected it to be, but it’s extremely useful for manufacturing companies and defense contractors. The radical decline in cost has made it much more feasible for these companies to start building it into their design and manufacturing workflows. That’s created a new market for virtual reality development that nobody would have expected when the oculus rift came out.

So what’s all this got to do with “blockchain”? Well, the idea of a blockchain is a particular sort of implementation of a more general concept called a distributed ledger. Distributed ledgers probably have a lot of productive uses in things like supply chain management, identity management, smart contracts, and other real economy sorts of uses. But you happen to be in the market right after the peak of the first stage of the hype cycle. So for right now, don’t expect a lot of interest in new blockchain shit. People are just going to associate it with cryptocurrency scams, and that’s just going to sour most people (investors and businessmen included) on the idea.

The idea of a distributed ledger is out and about now, and eventually companies are going to realize it has applications beyond scamming people with crypto currencies. That’s when you’ll see it start to come back.

Zoeba Jones

Hav smart contracts worked? No. People arguing over the meaning of words in court is not a bug. It is not a flaw. It’s the whole point.

Does deflationary currency work? Absolutely not. It simply encourages money hoarding.

Trust isn’t the problem, not that blockchain solves that problem either.

So what’s the point? What are we getting for the energy we’re spending on mining shitcins (and they’re all shitcoins, because none of them know how currency works)?

Piotr

While the blockchain is most well-known for being the innovation that makes cryptocurrencies (like Bitcoin and Ethereum) possible, there is something deeper here that the real fanatics (like me!) get really excited about.

Without getting into the nitty gritty details, the blockchain is an innovation in computer science that makes it possible for a decentralized network to come to a consensus on a sequence of events.

For example, what if I told some computers in Asia that I sent Bitcoin to you, but I told some other computers in America that I instead sent that same Bitcoin to my other friend? When those messages propagate through the network, which one trumps the other?

Traditionally, this question was essentially unanswerable, without using a trusted server to simply decide based on which one it had seen first. Blockchains solve this problem–google mining and minting of blocks to learn more.

The reason this is exciting is because it lets a group of people come together, work together, and more importantly, come to a consensus, without having to trust some third-party server somewhere that has control over the whole operation.

Bitcoin is using this innovation to make decentralized currency. Ethereum is using this innovation to make a decentralized computing platform. We are still in the early days, but the innovation of the blockchain itself is now far from unproven. These days we are building things on top of it, and only just scratching the surface of what it will enable.

Acula

Change is coming.. inevitably. Or rather.. change is inevitable. Agree?

ZoraBora

Several U.S. firms seeking regulatory approval to launch a bitcoin exchange-traded fund (ETF), has estimated that 95 percent of bitcoin trading volumes are faked and only 10 exchanges publish reliable data about volumes on their platforms, without inflated numbers.

TomK

In real terms however this is impossible since that would represent about half a billion dollars worth of computing power. Its also possible to see everyone’s share of network hash rate so its impossible to do this covertly. Even then, once you achieved 51% (and probably before you got that far) you would get all sorts of DoS attacks because it would be obvious what you were trying to do. And even if you somehow pulled it off, everyone would know you did it. And the gain from getting control over the network for 10 minutes just isn’t worth it anyway. Half a billion dollars of computing power, sustained, for 10 minutes and you get to do one double spend. Well done.

The economics of a 51% attack just do not make any sense its incredibly expensive to do, its impossible to accumulate the power covertly, and even if you do, as soon as you did it everyone sees you do it, and the economic rewards are really not all that great. There’s just no point in attempting it.

Adam Spark Two

Crypto is an intersection of multiple disciplines, Nick Szabo has been talking about Smart Contracts since at least the mid 90s: http://www.fon.hum.uva.nl/rob/Courses/InformationInSpeech/CDROM/Literature/LOTwinterschool2006/szabo.best.vwh.net/smart_contracts_2.html

The concept of eCash has been discussed for a long time too e.g. see this by the NSA (National Security Agency) from 96: https://groups.csail.mit.edu/mac/classes/6.805/articles/money/nsamint/nsamint.htm

There were a number of precursors to this, I just have these two links to hand.

johnbuzz3

Ethereum is also one of the few blockchains with a built in bank, which is enabled by smart contracts. In the past, when a whale cashed out of a coin, the price would decline and sometimes massively.

This should no longer be as big an issue on Ethereum because whales can simply deposit their ETH into a smart contract, say on makerdao, and access USD equivalent for spending.

Basically, ETH investors can have their cake and eat it too by preserving future gains in ETH, as ETH gains in value due to adoption, and unlock the value of their ETH for immediate spending.

Oscar P

Hope that sooner than we expect

Zoeba Jones

With great power exists great responsibility and dilemmas. Why at all is said here ‘WE will’ ‘for YOU’? While should be ‘WE will’ ‘for US’. Why to exclude someone from deciding about him/herself?

AdaZombie

Yes, this is a time for alternatives on the market, but … still giants are giants. Interesting year 2019 before us.

tom lee

I think we’re saying the same things in different ways.

Wall Street lobbies against any regulation that isn’t good for Wall Street… This is literally why we have the entire derivatives market… so Wall street lobbies hardcore to keep the government from restricting their gambling on derivatives…

This tokenization will be no different, “if” it were to happen, it would only be done in a way that benefits wall street, or they’ll lobby against it and ensure it doesn’t actually happen.

AdaZombie

“trusting technology is harder than trusting people.” This is an easy thing to say if you live in a high-trust culture with a reliable legal system, as is the case of North America, Europe, and a few other countries. Outside this region, things are very different. Unreliable legal systems mean that it is very hard to formalize trust, which limits the scope of economic activity to family and friends. Where I am living, Brazil, a contract is worth less than the paper it is written on, but if you *know* someone, then, wow, it’s important! My belief is that emerging markets will be the hotbed of blockchain adoption, and it will lead to nothing short of a global economic renaissance.

Check Batin

I think it is very dangerous to package the gate model of quantum computing in with the things that quantum effects can actually accomplish. Using statistical measurements quantum particles to secure a communications channel, generating random numbers, etc. Both are extremely important for cryptography. Adiabatic optimization is also a promising field, but we still haven’t gotten to a point where we can prove that it works better than regular optimizers. What is scary is how the gate model – the most flexible of quantum technology but the least likely to be feasibly implemented – is packaged in with all these other things. You’re packaging two proven successes with one likely success with one not-yet success. Basically, you’re doing with ideas what Wall Street did with mortgage-backed securities – stuff the thing full of badness, and sprinkle in a little goodness.

johnbuzz3

This is very true! VCs play a very important function, and I still believe they have an important function to play at the dapp and L2 layers. I am definitely more skeptical of their involvement at L1, especially when combined with mechanisms like on-chain governance.

Fortunately, Ethereum doesn’t really have to worry about this in the same way as some other chains do. It will be a very interesting experiment to see how this plays out on other chains.

CaffD

You are absolutely right that naively designed AI would simply inherit the biases, but there is certainly hope that a properly implemented AI tool can be more fair than human decision makers. I agree with you completely that it’s not a panacea, but as you say this is an area of active research.

TomK

It’s so impossible that it’s happened already! Don’t you remember when Ghash.io regularly gained >50% of the bitcoin network? I know you’re not new to this bitcoin stuff. There’s no way you just forgot about it.

Everyone knew what was happening. It was plastered across /r/bitcoin. People boycotted them – and it continued anyway!

In all probability, they exploited that power to carry out a different attack – the greedy mining attack – that caused them to find a higher proportion of blocks than their network share should have allowed.

Adeptus99

I’m impressed. Thanks for sharing this. It’s fascinating how you can find all these information in the data marketplaces nowadays. Thanks to blockchain, there are few projects I know like SciDex, they’re an excellent example for a decentralized solution to scientific data storage and sharing. There is high hope that better things are yet to come which will change data science, making it cheaper, more accessible and more accurate leading to better decision making and more accurate results for companies and consumers alike.

Adam T

2010 will be a year of blockchain

Simon GEE

Simple and elegant explanation of blockchain technology. Very nice 🙂

Karel Doomm2

Services and applications based on private blockchains and consortiums will thrive with less talk /theory and more real products and actual revenues being generated. The technical gaps will start to be filled around zero knowledge proofs and secure distributed storage (could 2016 be the year of IPFS?) to complement the blockchain ledger and smart contracts.

Mac McFisher

Great read. All the best in 2019

SimonMcD

I don’t know if we’ll make all that much progress in 2019, but we’ll see. The IoT and smart contracts in many ways go hand in hand. But what we really need is an open source solution.

tom lee

Yes, tokenization allows fractional shares. And guess what? SO DOES TRADITIONAL DATABASES. You just need to update the database architecture, which probably is going to take much less development, adoption AND maintenance cost than let’s say… blockchain tokenization! BTW, traditional relational databases are completely packed with security and transanctional features due to 5 decades of database researches. Even cryptocurrency exchanges use relational databases for internal trading processing purposes.

The only question that needs to be answered for considering employing blockchain is “does the application need a database that require concurrent read AND write by multiple trustless parties?”. For stock/security exchange storage? Usually that answer is a strong no, even for stocks. So, since you asked

Zoeba Jones

It’s useless for energy, securities, banks, and currencies. So far, the only application that makes any sense is a single world currency, btc.

Why is it useless for energy? Because energy is government-regulated. All parties are known and trusted.

Why is it useless for securities? Because securities are government-regulated. All parties are known and trusted.

Why is it useless for banks? Because they’re also regulated. All parties are known and trusted.

Blockchain is just a shitty, slow database that you can only write records to, and read records from. You may never change records in blockchain (I’m aware this is an oversimplification and wrong in specific cases/details). The unique advantage of a blockchain database is that it practically solves the two generals problem so you can have a pretty trustworthy distributed database even while a significant portion of counterparties are unknown and/or untrustworthy.

So, why would anyone trading energy need a blockchain database? They’re regulated out the ass, their counterparties are well-known. Just use a regular database.

Why would anyone trading securities ever use a blockchain? You already have FINRA, SEC, exchanges, and more. Just have each exchange or a government agency run a much lighter, faster database where you could, if necessary, change entries in the database easily. You’re already trusting these overseers to trade securities, so there’s no need to use a slow-ass decentralized database. In fact, speed is valuable in trading securities, so blockchain is wildly inappropriate!

Why would banks use a blockchain? Well, if you’re laundering money, you should use bitcoin. Otherwise, you should just use a database. It’s faster, cheaper, and you already know and trust your counterparties. Nobody’s identity is secret in legit banking.

Zoeba Jones

I found your article both fascinating and frightening in equal measure!! We can only hope that the ethical debate remains high on the global agenda with a clear dialogue redefining war crimes (both human and AI driven) and culpability.

TomK

If you do a job search for “blockchain” you’ll find a lot of places (many very established like Amazon, Facebook, Fidelity, etc) hiring blockchain developers or more commonly software engineers that work with blockchain in some form. However, the odds of you landing your first job as a blockchain developer is unlikely to happen. I don’t think many people want a junior blockchain dev due to the immutable nature, probably makes the cost of screwing up higher.

John McLean

Research proof of stake. It is an alternate method to validate transactions and secure the network but does not rely on computational power.

Jack23

Blockchain != Bitcoin

Bitcoin == Blockchain

You can do a lot more with the Blockchain technology of immutable records (which it essentially boils down to). Unfortunately, due to poor programming there have been lost a great number of records (in this case cryptocurrency) in the past, because those records were no longer valid.

Norbert Biedrzycki

Blockchain explained – bitcoin example

Tom299

Yeah! Blockchain is a disruptive technology because of it’s ability to digitize, decentralize, secure and incentivize the validation of transactions.

TomK

Blockchain is a specialized trick for coinz and really doesn’t have any outside applications other that something in the trading industry for that purpose.

As soon as you start trying to “look outside the box” with coinz, you realize blockchain size will always be your ball’n chain and the only way to mitigate, is to put a head on to the chicken.

Now you have zero need for the blockchain.

Norbert Biedrzycki

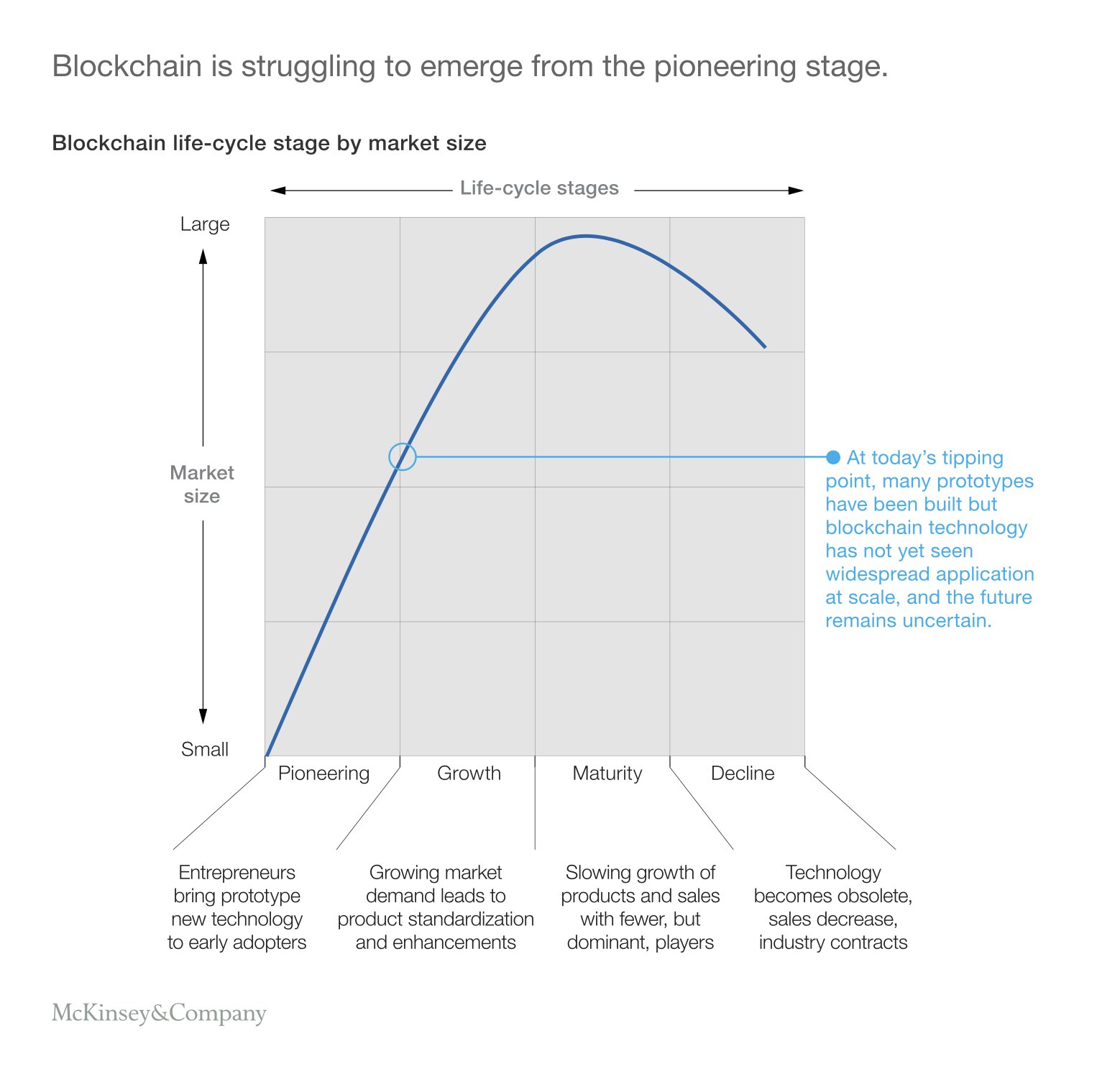

Blockchain is struggling to emerge from pioneering age. Still no killer app except crypto @McKinsey

Tom299

Amen 🙂

TomHarber

An actually interesting, well though-out and articulate article on Medium.com? Is this a beginning of a new era?

TomHarber

I know someone who’s country manager of an auto company. He’s great at selling automobiles – but like everyone c-level, they assume success in one field automatically makes them visionaries in all. Recently he told our group about how Blockchain will revolutionize the auto industry. Someone asked him about the applications. He replied that Blockchain will create a “non-repudiable sequence of transactions”.

When others asked him who will manage the Blockchain and who the target users are, he said, “we will figure that out as we go along.”

Often people just throw new faddy words to sound intelligent. AI, Blockchain, etc are the asshole words of our time. The technology and science are legitimate and might be huge for society/ industry in time, but they often get hijacked by the hype cycle.

TomK

Focusing on the current market needs will force the leaders to appear immediately for a project and on the whistle.

The Cheerful Pixie dreams and wonders what the defense industry will look like and whether the upcoming changes will also touch politicians world?

tom lee

There is no such thing. The advantage to Wall Street is that they are in control, and have future knowledge on what the rules are.

That’s why Wall Street loved Obama, and hates Trump. Obama had an ‘anti-Wall Street’ attitude, but the traders could still trade favorably, as they knew what was coming. Trump? Who knows what his administration is going to do next.

TonyHor

This is a key point. Smart contracts allow anyone to be trusted because the contract is public and immutable. Smart contracts democratize financial transactions and no one has been able to sufficiently explain to me why that’s a bad thing.